Listen to “The OPEX Effect” podcast – targeted to those of you will investing time frames past a few weeks. Here we cover some interesting trends in equity volatility, and breaking its link to interest rates. Also some call buyers in both the Magnificent 7 & cryptos.

options expiration

This Might Not Be a September to Remember: Options Expiration + FOMC Risk

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The September monthly options expiration, which also happens to be a quarterly quadruple witching, occurs just days before the next FOMC meeting. As noted previously, the market appears to be anxious about this upcoming meeting, and it is easy to understand why. The prospects […]

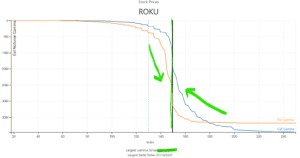

ROKU Analysis 8/14/20

ROKU has an interesting setup day, as we show ~43% of options gamma is expiring today. Most of the options in ROKU are also at the 150 strike, which may setup an interesting “pin” play. The idea here is thats the options decay hedging flows (which are tied to 150) push the stock back towards […]

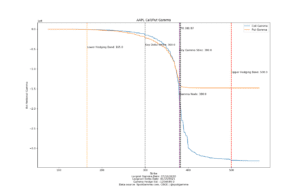

FAANG Options Expiration Gamma Pin

Our equity analysis models are in BETA but as we watch the data come in we pick up on a few interesting things. One of those was today when 4 our of the 5 FAANG (AAPL, AMZN, NFLX, GOOGL) names have their highest “gamma expiration” today: 7/10/20. Whats also interesting is that at the time […]

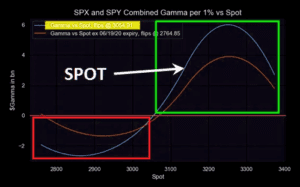

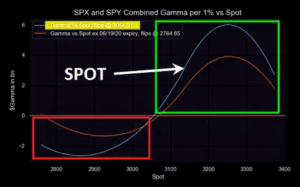

SPX Same Day OPEX

We ran a detailed analysis of the impact of same day options expiration volume vs open interest and the effect this may have on “pinning” the market into the close. Some may also refer to the idea as “options max pain”. You can read it here but we thought it was worth showing the effect […]

Opex Quadwitching Rebalance Market Shenanigans

We are posting this as a reminder to all those that want to play in the market during large OPEX days also known as Quad Witching. Below is snapshot from the CBOE official settlement page. It shows an opening price of 3161 which is where all of the SPX AM options would officially be marked. […]

SPX Options Expiration vs Equities

We spend a lot of time talking to our members about the lack of structure in the SPX options market. What we mean is the positioning in SPX options is just very small as seen in this chart below which maps total SPX call & put gamma. This has implications for markets not just at […]

Nomura June OPEX Update

“Following Friday’s Serial/Quarterly options expiry, we continue to see potential for a ‘Gamma Unclenching’ over the following 1w-2w period with currently ~47% of the $Gamma set to run-off” – Nomura’s Charlie Nomura marks a much lower gamma flip point of June options expiration, which would suggest markets may open in more positive gamma territory after […]

Nomura 6/12/20 Gamma Update

Watch possible “gamma sweating” should this turn lower again Nomura’s quant explains the move yesterday; And here is why this this matters: as stated in the note to this point, yesterday was classic butterfly effect knock-on, with a “macro catalyst” from the COVID wave #2 risk-off trade which then triggered “profit-taking-turned-stop-loss selling” from both tactical […]

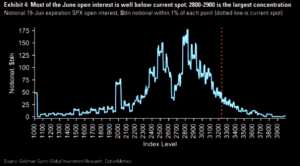

Goldman: All You Ever Wanted To Know About Gamma, Op-Ex, And Option-Driven Equity Flows

From ZeroHedge: In our daily observations of (bizarre) market moves (usually in the context of comments from Nomura’s Charlie McElligott and Masanari Takada), we frequently analyze the delta-hedging of option positions by dealers, i.e. gamma, which for a variety of reasons has emerged as one of the dominant drivers of risk assets (at least until […]