by Renato Leonard Capelj “I’ve actually never seen a stock go up endlessly on nothing.” That’s according to CNBC’s Jim Cramer who commented Monday on Tesla Inc’s (TSLA) near-vertical price rise on the heels of record quarterly revenue and profit, as well as news that Hertz Global Holdings Inc (HTZZ), a rental car company that […]

TSLA

SpotGamma on Dave Lee Show: TSLA

What’s Next for Tesla Stock? Understanding a Gamma Squeeze

SpotGamma on DeepDive CA

SpotGamma had the pleasure of being on DeepDive with Steve and Jay. We talked about meme stocks, dark pools and naked shorting.

HIRO Indicator Shows Bearish TSLA Options Flow

As put flows pile in on TSLA, there could be a put driven gamma squeeze down in the stock.

TSLA Options For Sale

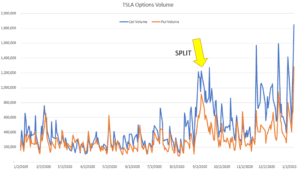

The week ending 1/8/21 saw a record high in TSLA options volume, with the stock surging nearly 20%. Traders have been flooding into weekly options as the way to express their views on the stock which was just recently added to the S&P500 Index. We view increased buying of call options as a driver for […]

TSLA S&P500 Add Shenanigans

Note that last candle, which closes the stock at $695 – the days high. Did someone really just pay $695 for $TSLA shares? pic.twitter.com/zi5UrJopbq — Joe Weisenthal (@TheStalwart) December 18, 2020 TESLA TRADING VOLUME AT 180 MILLION AS STOCK SETTLES AT END OF SESSION, TURNOVER AT $122 BILLION — *Walter Bloomberg (@DeItaone) December 18, 2020 […]

TSLA into the S&P500

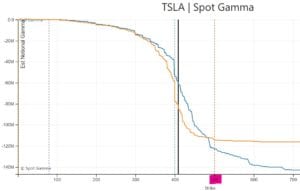

In TSLA the largest gamma area was $600 heading into today. The stock traded down to $605 earlier this AM, $620 now. The largest volume & OI region is >=$650 44% of TSLA gamma exp on close of12/18, by which time ~$50bn of TSLA stock needs to be bought by S&P indexers

Nomura + SpotGamma – 2.5 Trillion Reasons To Care About This Week’s ‘Quad Witch’ Options Expiration

2.5 Trillion Reasons To Care About This Week’s ‘Quad Witch’ Options Expiration From ZeroHedge:Tue, 12/15/2020 – 11:55 Like all December option expirations, this month’s is large, with $2.5tln of SPX-linked options notional (linked to 8% of the S&P’s market cap) expiring on 18-Dec, but for a December, it is not extreme… Nomura’s Charlie McElligott notes […]

TSLA Timeline into the S&P500 Add

TSLA will be added to the S&P500 Index next week, and will be approximately 1.5% of the index. We covered the mechanics of this add, here. The chart below highlights the key recent events, and some relevant future dates. The “$” markets indicate where Musk has received a bonus in the form of TSLA options. […]

TSLA Added to the S&P500

Last night the S&P announced that TESLA (TSLA) would be added to the S&P500 (SPX) Index by Monday 12/21. What this effectively means is that anyone that has funds (pensions & other large asset managers) indexed to the S&P500 will need to purchase TSLA stock, and will sell whichever stock(s) TSLA is replacing(TBD). As TSLA […]