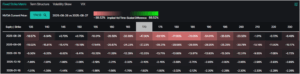

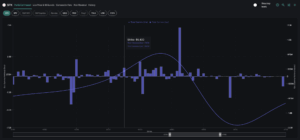

The S&P 500 closed the week at 6,661, posting a 1% weekly gain as markets navigated through the highly anticipated FOMC. What made this week particularly noteworthy was the extreme complacency at its start: one-month realized volatility sat at a meager 8%, and implied volatility hit basement-level 5% for this past Monday. These are some of the […]

Market Analysis

Zombie Market Faces a Triple Witching OPEX

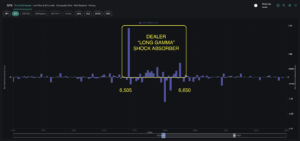

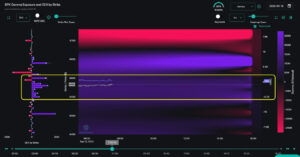

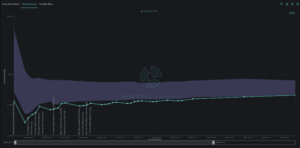

The S&P 500 delivered a grinding week, closing at 6,584 on Friday and up 1.3% from Monday’s open of 6,498. The 6,505 JPM Collar call acted as a critical pivot, where previous resistance turned into support. We shared our zombie market thesis in our Founder’s Note on Monday morning: current positive dealer gamma – driven by extremely short-dated options […]

The Record-Setting 0DTE Showdown

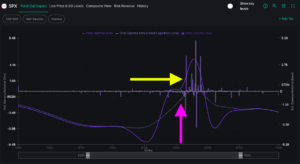

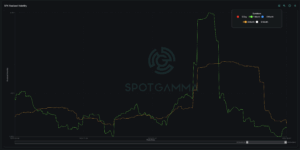

The S&P 500 delivered a volatile week: Tuesday began with risk-off positioning and a negative gamma environment, evolving into Thursday’s explosive rally, finally culminating in Friday’s blowoff top. The result? SPX closed almost exactly where it started the week at 6,482. By Wednesday, 0DTE options hit a record-setting 70% of all options volume, keeping the market […]

Low Volatility Keeps S&P 500 in a Fragile Calm

This week saw the zombie market resume with suppressed volatility and a broader market remaining constrained by positive gamma. SPX closed the week at 6,460, grinding slightly higher throughout the week before the rug was pulled on Friday. NVIDIA earnings on Wednesday served as the pivotal moment that shaped both volatility patterns and the broader […]

The “Zombie Market” vs. NVDA Earnings

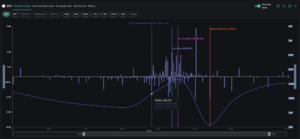

The sell-off last week exemplified a classic post-OPEX window of weakness, reinforced by Wednesday’s VIX expiration. With structural support somewhat removed, the market experienced a measured four-day decline from 6,455 to 6,345. Then, Powell’s Jackson Hole speech on Friday delivered exactly the dovish tone markets were hoping for, triggering a sharp reversal that saw the […]

Volatility Drought Persists Through OPEX

SPX ended the week at a major SpotGamma support level of 6,450, driven by a combination of volatility compression, stabilizing dealer hedging flows, and the power of large options positioning. This week followed the trajectory outlined in our Founder’s Note on Monday morning: a benign CPI reading sent volatility even lower, and the SPX rose from 6,360 […]

Market Drifts Through “Death Valley” Vols

The S&P 500 delivered a week that looked dramatic at times, but ended up just drifting slightly — closing up 1.8% after a wild ride. While volatility spiked early in the week from tariff deadlines and semiconductor earnings disappointments, IV quickly collapsed as 0DTE flows reasserted control. This vol crush became a self-reinforcing tailwind for […]

From “Zombie Market” to Vol Awakening

What a difference a week makes. The S&P 500 went from consistently hitting all-time highs with 6,450 touched on Wednesday to close Friday down 1.6% to 6,238.This dramatic shift from “zombie market” to spiking realized volatility exemplifies the need for protective puts and/or VIX calls as insurance, as we highlighted in the daily pre-market Founder’s Notes throughout […]

Animal Spirits Roar as Market Catalysts Loom

This week delivered a fascinating mix of meme stock chaos, trade deal optimism, and mega tech earnings keeping traders on their toes despite unusually calm waters for the broader market. The S&P 500 ultimately gained ground, closing at all-time-highs, just below the pivotal SPX 6,400 gamma strike. Call option volumes exploded this week alongside broader […]

July OPEX Opens the Window of Weakness

This week delivered everything from mini-flash crashes to meme stock explosions, capped off with a July OPEX that reinforced our thesis about dangerously complacent volatility expectations. Our key levels proved their worth again this week: resistance at 6,325 limited upside attempts, and support zones at 6,250 and 6,200 provided reliable bounce points. The 6,200 pivot […]