CLOV is a healthcare SPAC that is quite popular with the wallstreetbets crowd. It typically carries a very large amount of open interest, and along with that a lot of options gamma. Because of this CLOV seems to pin SpotGamma’s highest gamma strike. In the chart below you can see this highest gamma strike for […]

Stock

SPX Options Vanna Into the April Rally

The S&P500 has been surging the last several days, following several large options expirations at the end of March. With this we have seen a change in the forecast of our vanna model, which we use to forecast dealer buying or selling pressure. Vanna is the change in an options delta for a change in […]

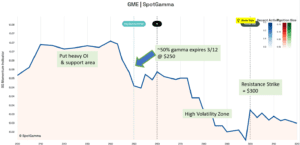

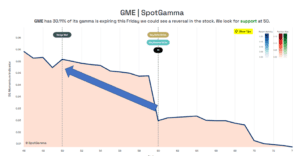

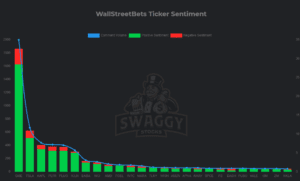

GME Gamma Squeeze Update

Yesterday we added a video which provided an update on our GME gamma squeeze model. We noted that some 50% of total GME gamma was set to expire at the close of trading on Friday, March 12th. The strike with the largest gamma position was the $250 strike, with most of that held in puts. […]

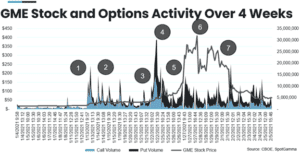

The GME Gamma Squeeze

In late January 2021, GameStop experienced a once-in-a-decade squeeze that has captivated the world’s attention. This was a premeditated and programmatic exercise, orchestrated by coordinated stock and option buying across the retail and professional community, that resulted in large institutional entities losing billions of dollars. These investment houses with significant short positions did not expect a stock with […]

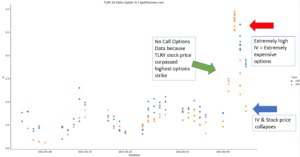

TLRY & Pot Stock Gamma

When a stock trades higher at a very rapid pace the price of the stock can pass the highest available options strike. For instance, at the start of the day on 2/9/21 the available call options strikes for Tilray (TLRY) ranged from ~5-$50. However the stock ripped over 50%, passing the 50 strike. When a […]

GME Options Pin

On 2/1 with GME stock at $225 we wrote about how options dealer flows could result in the stock dropping to the $60 strike. We highlighted this strike because it was where the largest concentration of options were placed (from a gamma perspective). You can see that is is precisely what has played out: This […]

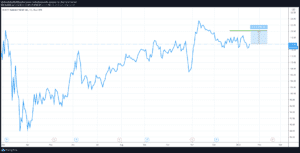

WM Rally Due?

Waste Management (WM) may get a bid with an infrastructure package, and we note that the 120 strike is concentrating in size. The stock is currently at $115, and has held that level more or less since October. We think hedging around options positions may give it a boost up into $120. You can see […]

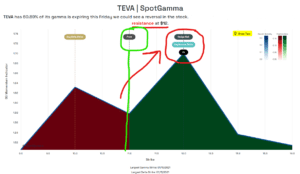

TEVA $12 Pin & Release?

TEVA is up about 10% the last several days, with a lot of gamma concentrated at the $12 strike. Most of this (~60%) expires Friday, 1/15. We therefore have compression under the key level of $12 as out of the money calls decay and keep a lid on TEVA prices into 1/15 expiration. Our EquityHub […]

GME Ran Out of Options Strikes

GME stock closed at 31.58 today, +57%. This was a bit off its high of $38.38, or 90%. This stock traded 589k calls today, >375k of which expires in 2 days. Amazingly the stock “ran out” of call strikes, with the highest strikes being $40. Traders used that 1/15 expiration, $40 strike call to trade […]

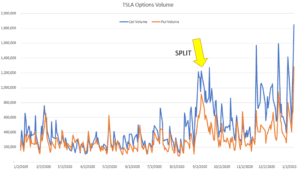

TSLA Options For Sale

The week ending 1/8/21 saw a record high in TSLA options volume, with the stock surging nearly 20%. Traders have been flooding into weekly options as the way to express their views on the stock which was just recently added to the S&P500 Index. We view increased buying of call options as a driver for […]