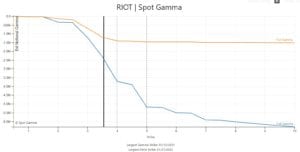

RIOT is quite interesting here as a potential bullish play. Its not a name with huge options volume, but being that its a trendy space (blockchain) and calls are low priced (retail can easily buy a bunch) we think the setup is interesting. If you note we pickup $4 strike as resistance (aka HedgeWall) and […]

Stock

VEXING VIX

Shorting VIX has been the big pre election play, and we noted recently during market draw downs that VIX put volumes have increased. This indicates VIX sellers are taking advantage of higher VIX prices to bet on a collapse in volatility. Today we note the S&P is down ~3% and the VIX Put Call Ratio […]

INTC Post ER

Update: We posted this to twitter last night after INTC missed earnings and was down -10% after hours. $INTC is -10% after ER’s. There is a lot of OI at 50, particularly in puts. The bulk of those positions sit in the 11/20 exp, so there could be extended pressure into low 40s. (Often in […]

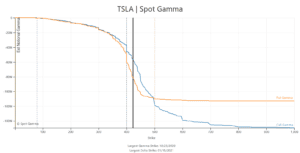

TSLA Has Less Spark

TSLA announced earnings last night which beat expectations and the stock reacted… fairly normally. No insane pops or drops. We think much of this tepid reaction is due to the relative lack of gamma compared to past earnings periods (see here). Below is a chart of the current gamma levels in TSLA, and you can […]

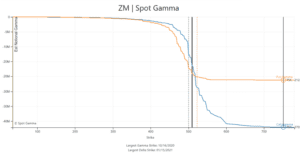

ZM ZOOM ZOOM

Call buyers are out in full force in ZM. Going into today there was ~250k calls outstanding. Today so far we’ve seen 150k calls trading, with 520-550 strikes in tomorrows expiration particularly active. Note below the 10/16 expiration call volume (left col) is heavily outpacing open interest (2nd from left). Going into today our EquityHub […]

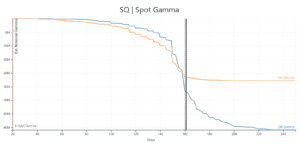

SQ Profile

SQ has been off to a strong start lately, with our model picking up 160 as a major area in the stock. You can see that above there gamma is positioned to support a shift into the 180 area. Below 160 we think the stock has more limited downside do to the concentration of calls/puts.

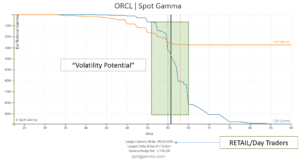

ORCL Launch?

One of the names catching headlines recently is ORCL. They have a conditionally approved deal to takeover TikToc, and that appears to have call buyers excited. In the chart below our “Hedge Wall” (blue dotted line) is at 60 – this is a key support/resistance level in the name. Note the blue call gamma line […]

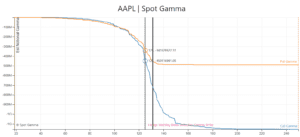

AAPL Options Gamma Unwind

It’s September 3, 2020 and parts of the market crashed. Let’s start with AAPL.

AAPL Options Insanity

From ZH And since nothing else has changed and we already showed what is going on from a delta- and gamma-hedging perspective… … we will give the last word to the Bear-Traps report which describes the “Insanity” in Apple Options: The convexity skew picture on big-name equities like Apple $AAPL has gone parabolically stupid. Let’s keep this […]

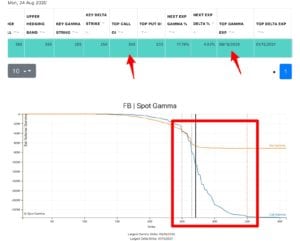

FB Making a Gamma Move?

FB has an interesting setup here as call gamma is consolidating around 265 and call open interest is building up around the 300 strike. If this call building trend continues it may cause increased volatility in the name. Volatility infers movement, which could be a rapid move higher OR lower. In this case we give […]