The following is a guest post from Doug Pless. When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for SPX and SPY. I also look up […]

Equity Hub

Trade Analysis: NQ Futures (14 December 2021)

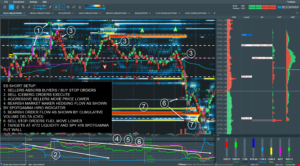

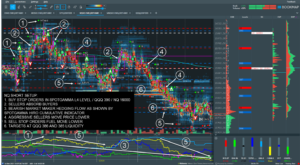

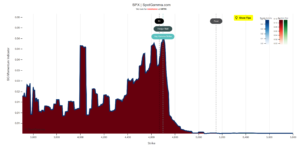

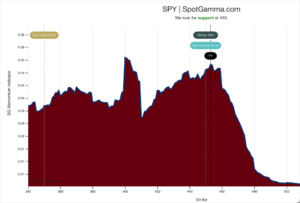

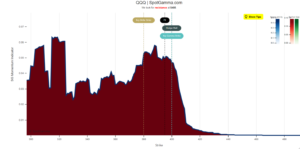

The following is a guest post from Doug Pless. When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For NQ futures, I note Gamma Notional, and the Volatility Trigger, Put Wall, and Call Wall gamma levels for QQQ. I also look up QQQ in Equity Hub. […]

Trade Analysis: ES Futures (10 December 2021)

The following is a guest post from Doug Pless. When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for SPX and SPY. I also look up […]

Trade Analysis: NQ Futures (29 November 2021)

The following is a guest post from Doug Pless. When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For NQ futures, I note Gamma Notional, and the Volatility Trigger, Put Wall, and Call Wall gamma levels for QQQ. I also look up QQQ in Equity Hub. […]

The S&P 500 May Drop An Additional 10%

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. On November 12, I warned that dreams of a seasonal run higher were in doubt and that an end-of-year melt-up could quickly turn into a meltdown. It seems that instead of stocks cruising into the end of the year, they have […]

If These Bond ETF Levels Break, You Better Buckle Up

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. There is instability in the bond market right now. In the face of a potential break, there may be a wave of volatility as market participants begin to price in changes to Fed monetary policy. Cracks are already showing as bond […]

From Melt-Up To Melt-Down, Why The Stock Market May Be Due For A Year-End Correction

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Investors have watched the S&P 500 rise by as much as 10% since the October 4 lows, while the NASDAQ 100 has increased by 14.5%. It has left many investors dreaming about an end-of-year melt-up for equities due to seasonal factors and the fear […]

Trade Analysis – NQ Futures – 24 September 2021

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels and key metrics for SPX and SPY. For NQ futures, I note Gamma Notional, and […]

Trading NQ Futures Using QQQ Equity Hub Data and Vanna Model

The following is a guest post from Doug Pless. As discussed previously, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels and key metrics for SPX and SPY. For NQ futures, I note Gamma Notional, and the Volatility Trigger, Put […]

Trading Stock Using Equity Hub and Dark Pool Indicator

The following is a guest post from Doug Pless. As I have discussed previously, my stock trading strategy is to look for long positions in stocks with actively traded options early in the week. Many traders open bullish option positions early in the week with short-term options that expire at the end of week. As […]