Good article here about active/passive investing and the thread of robots breaking the market. There is a good description of “gamma traps” and liquidity around options gamma. Two interesting pieces: When gamma is positive, options quickly get more valuable when the price of the related shares rise. The bank taking the opposite position to the […]

futures

Review of Flash Crash of May 6, 2010

Some liquidity notes from SEC review of the “Flash Crash” of 6/10/2010. Day started off with video of riots in Athens. Market was down a few percent and VIX was up. Liquidity started to thin out (from what was already low levels), then a massive futures order came in ($4bn notional). The order was one […]

Gamma Driven VIX Drop

There was quite a large move down in the VIX overnight (8/20/19) and Nomura claims that was due in part to the gamma around a large VIX position. This gamma driven VIX drop is apparently related to hedging around a large VIX position. When options decay this can effect the amount of hedging that a […]

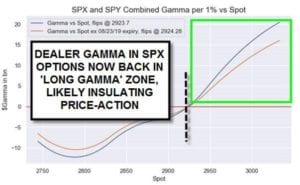

Nomuras Analyst Jumping the Gamma Gun

Nomura published an updated gamma chart showing that options dealers are now “Long Gamma…likely insulating price-action”. Nomuras options gamma estimate of 0 at 2923 is essentially the same level as our “Volatility Trigger” which is 2920. The issue with their analysis is that appears to be jumping the gun. Zero and positive are not the […]

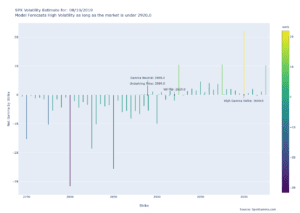

Gamma Market From 8/16/19

Volatility will continue to reign until (if) the market recaptures 2920. There is a ton of fuel ready to burn and one headline (or tweet) will send the market flying. The only recommendation that is safe here is to not sell any options, being short volatility is very dangerous here, as a >3% rally is […]

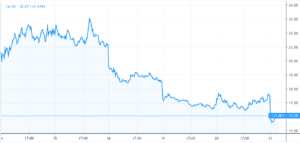

Dealers Running Out of Gas 8/16/19

After a sharp rally this morning the S&P500 stands at ~2890. This is where dealers buying starts to soften up. You can see their volume profile in the chart below. They were strong buyers up to this level but we calculated 2891 as the level where their buying wanes and 2920 where they flip to […]

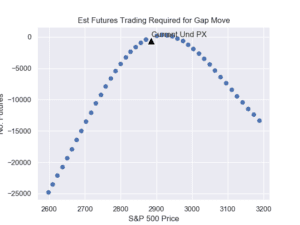

Dealer Futures Flow 8/14/19

Here is a chart estimating the futures action with the S&P500 at 2850. If markets head lower it looks like dealers will sell more futures, compounding the move down. The same works in a rally, but instead of selling those dealers will be buying. All this flips when/if the market moves over the VFLIP line […]