Through an options market lens, the following text will add color to some recent market movements.

liquidity

Options are a Larger Piece of the Liquidity Puzzle

Aretemis posted this graphic depicting the size of the options hedging market relative to other large flows. As options volumes increase its likely that volatility increases due to the mechanics of dealer hedging. Flows have killed fundamentals US Stock Market is now the derivative of the US Options Market …. a Frankenstein monster patched together […]

Mondays Market SPX Slide 5/12/20

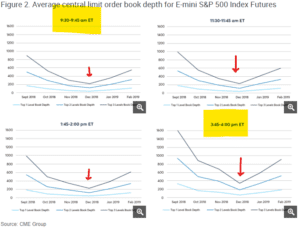

Yesterday markets fell apart pretty quickly and that leads us to highlight ES volume and the poor liquidity seen. You can see in the chart below that ES volume was higher than its recently been and a lot of that was concentrated into the close. This leads us to an interesting point about ES Futures […]

Stock Market Depth of Book: Liquidity vs Liquidity “Quality”

CME posted an interesting analysis called “Alternative Liquidity Measures” about volumes and depth of book. Their view is that liquidity doesn’t disappear during crisis times. The central argument is something along the lines of: “How can liquidity be worse if volumes skyrocket during market drops?” And that is actually a solid point. Yeah, you can […]

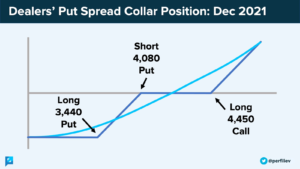

“ALGOS” will Destroy the World! Gamma Traps and Liquidity

Good article here about active/passive investing and the thread of robots breaking the market. There is a good description of “gamma traps” and liquidity around options gamma. Two interesting pieces: When gamma is positive, options quickly get more valuable when the price of the related shares rise. The bank taking the opposite position to the […]

Review of Flash Crash of May 6, 2010

Some liquidity notes from SEC review of the “Flash Crash” of 6/10/2010. Day started off with video of riots in Athens. Market was down a few percent and VIX was up. Liquidity started to thin out (from what was already low levels), then a massive futures order came in ($4bn notional). The order was one […]