The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Investors have watched the S&P 500 rise by as much as 10% since the October 4 lows, while the NASDAQ 100 has increased by 14.5%. It has left many investors dreaming about an end-of-year melt-up for equities due to seasonal factors and the fear […]

Michael Kramer

Weakening US Dollar Sparks Short-Squeeze Rally

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Stocks ripped higher the week ending October 15. The spark stemmed from a sharp decline in the dollar index, as the currency market grew concerned about hotter than expected wage growth as part of the US Consumer Price Index the morning […]

Earnings Uncertainty Could Cause a Market Meltdown

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. As uncertainty ticks higher in markets, volatility tends to follow. There is a tremendous amount of doubt building in the equity markets, especially regarding corporate earnings. With the market on the cusp of earnings season, volatility may see a massive spike. […]

A Volatility Crush Is Masking An Unhealthy Stock Market

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The S&P 500 finished the week ending September 24 up a mere 50 basis points, a tranquil week – on the surface. Volatility was fierce to start the week, a dynamic predicted by SpotGamma and shared with their subscribers last week. […]

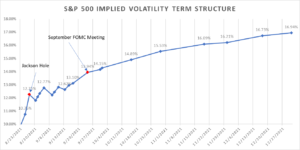

This Might Not Be a September to Remember: Options Expiration + FOMC Risk

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The September monthly options expiration, which also happens to be a quarterly quadruple witching, occurs just days before the next FOMC meeting. As noted previously, the market appears to be anxious about this upcoming meeting, and it is easy to understand why. The prospects […]

Volatility In The Markets May Rise Dramatically As Jackson Hole Approaches

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Jay Powell will speak at next week’s Jackson Hole Economic Symposium. Some investors think it may be where he lays out the Fed’s path towards the tapering of asset purchases. Recent economic data suggests that inflation is running at levels that […]

The Fate Of The S&P 500 Rests In This Handful of Stocks

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. *Disclosure: Michael Kramer and the clients Of Mott Capital Own AAPL, GOOGL, TSLA, & MSFT. This week could mark a turning point for the equity market with a Federal Reserve meeting and nearly all the mega-cap companies reporting results. Unfortunately, many […]

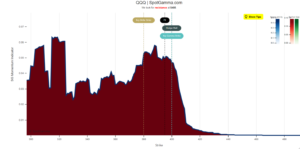

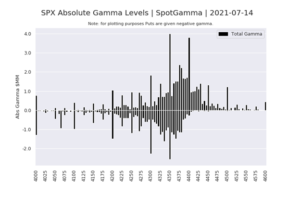

The Unclenching Of Gamma May Unleash The Overbought Stock Market

The following post is courtesy of Michael Kramer of Mott Capital Management. Reach him on Twitter. Since the big June options expiration, US equity markets have run sharply higher. Starting on June 18, the S&P 500 has gained an unexpected 5%. The move higher has come despite many economic reports suggesting the economy may have […]