In two recent media appearances, Brent Kochuba, Founder of SpotGamma, broke down his theory about how impactful NVDA short dated options are to the US stock market. Hint: very. First, this was discussed with Victor Jones of TasyTrade, and then with Jack Forehand of ExcessReturns. In recent market activity, we’ve seen significant movement in NVIDIA […]

NVDA

Case Study: A Step-by-Step Bearish Trade Breakdown of Nvidia (NVDA)

Author: Doug PlessProfessional Trader & SpotGamma Content Contributor Case Study: A Step-by-Step Nvidia Bear Trade Breakdown In this case study, full-time Professional Trader and SpotGamma Content Contributor Doug Pless demonstrates how he uses SpotGamma tools to plan and execute a trade in Nvidia stock. The process involves positional analysis, focusing on market makers’ positions and […]

Stock & Bond Correlations: “No Crying in Correlation”

Alpha Exchange

Office Hours with Imran: Key Strategies for Navigating Volatility, Black-Scholes Calculations & Volatility Skew Insights

### You must be logged in to access this content. Don’t have an account with SpotGamma? Sign up today to view unique key levels, Founder’s Notes, market commentary, options analysis tools, and expert insights. If you’re already a SpotGamma subscriber, log in here: Username or E-mail Password Remember Me Forgot Password

Unpacking May OPEX: How Will Low Volatility and NVDA Earnings Shape The S&P 500?

Key Points: A Brief Synopsis: Large call positions are driving low volatility into May options expiration. The expiration of call positions lines up with several key data points (Fed Speaking, CPI) which may cause volatility to briefly expand into the end of this week (Friday, 5/17), and into VIX expiration & NVDA earnings on 5/22. […]

Trade Analysis: NVDA Flashback (March 14, 2024)

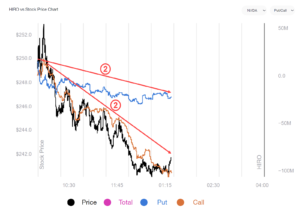

Author: Doug PlessProfessional Trader & SpotGamma Content Contributor In this comprehensive trade analysis, professional trader and SpotGamma content contributor Doug Pless delves into the intricacies of trading NVDA on March 14, 2024. Utilizing advanced tools such as Equity Hub and HIRO Indicator, Doug meticulously outlines his morning planning routine, providing insights into key metrics like […]

Trade Analysis: NVDA (July 20, 2022)

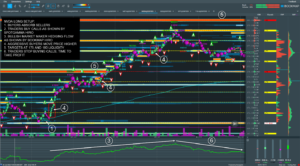

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, Key Delta Strike, and other metrics for each stock and compare the values with the previous […]

Trading Stock Using Equity Hub and HIRO

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, and other metrics and compare the values with the previous values for the last five days. […]

Trading Stocks With SpotGamma and Bookmap HIRO

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, and other metrics and compare the values with the previous values for the last five days. […]

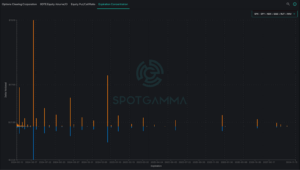

There Are Times When Nothing Is Happening

The goal of HIRO is to alert users as to when options order flow may be impacting a stocks price. Equally important is knowing when options are not involved! A member asked us today about NVDA’s flow, and our response was “there’s nothing going on!”. This can be seen by the fact that the HIRO […]