Everyone’s talking about options flows and how same day (0DTE) trading is impacting market prices. While options flows do not drive stocks *all* of the time, there are critical moments when these flows directly influence stock prices. For 0DTE in particular, it’s the buildup of Delta that can move markets. In September 2023, the CBOE […]

Market Analysis

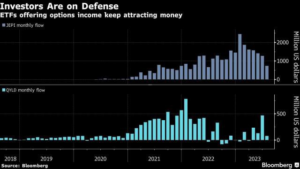

JEPI Options Strategy Straight from the Portfolio Manager

JEPI Portfolio Manager Hamilton Reiner appeared on Animal Spirits and gave several critical insights into how the strategy works. JEPI is one of the largest ETF’s in the world, with $28bn in AUM. The growth of this ETF has been tremendous, as shown in the top chart, below. Hamilton may be best known in the […]

How 0DTE Options Flows Move Stock Markets

What a legendary post! Spot on. $SPX 4400 it is! @spotgamma https://t.co/1dbjB9eo8p — magicavi (@magicavi89) August 25, 2023 The following analysis was revealed in real time both to our SpotGamma members, and posted to our Twitter account, in real time. On Friday August 25th Fed Powell gave a speech at the Jackson Hole symposium. This […]

August 2023 OPEX: Will volatility break out?

**Access to a full list of stocks with estimated IV Rank impact is available at the end of this article** SpotGamma Models Reveal IV Rankings for OPEX Trading + Analysis Despite the 3% decline in the S&P 500 over the month of August, both S&P 500 realized volatility and implied volatility has remained muted. “Market […]

Did Michael Burry Spend $1.6 Billion on Puts? NOPE!

The media is excited about the recent 13F filing from Michael Burry, which suggests that he owns a large put position in the SPY & QQQ ETFs. However, the actually position is not that big. This is due to the strange way that the regulators value options. The dollar amount listed on 13F (middle column) […]

Noel Smith: Volatility, Correlation and Edge

Below is an automated transcript of our conversation. As it is automated, please forgive any grammatical errors. [00:00:00] Brent Kochuba: Joining me today is Noel Smith of Convex Asset Management. And the reason I want to have Noel on today is because there’s all sorts of interesting things happening in the volatility landscape. [00:00:08] And […]

How Changes in Interest Rates Impact Options Prices: A Comprehensive Guide to “RHO”

Understanding the dynamics of options pricing is essential for anyone delving into the world of options trading. Among the various factors affecting options prices, changes in interest rates play a significant role. In this article, we’ll break down the relationship between interest rates and options prices, and how to navigate this complex landscape. The Basics […]

VVIX, Vol-of-Vol and Stock Market Returns

After the market close on August 1st, the Fitch rating agency downgraded US debt. This brought a bit of volatility to US stock markets on August 2nd. The downgrade was the first such occurrence since Standard & Poor’s downgraded the U.S.’s long-term sovereign credit rating from AAA to AA+ on August 5, 2011. Markets were […]

Samantha LaDuc: Spotting Macro Trends Early and Leveraging Option Market Structure to Identify Potential Opportunities

### You must be logged in to access this content. Don’t have an account with SpotGamma? Sign up today to view unique key levels, Founder’s Notes, market commentary, options analysis tools, and expert insights. If you’re already a SpotGamma subscriber, log in here: Username or E-mail Password Remember Me Forgot Password

SpotGamma on Excess Returns

Summary Brent Kochuba, founder of SpotGamma, discusses the impact of the rise of 0DTE options, fixed strike volatility and the implications of options expirations. Highlights Below is the transcript from this conversation: welcome to excess returns where we focus on what works over the long term in the markets join us as we talk about […]