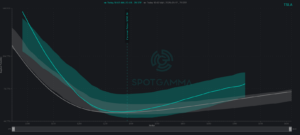

TSLA has been on an incredible +50% move for the month following the 11/6 elections. SpotGamma wrote extensively about the very bullish setup we saw on 11/7 – a setup that was more bullish than general market expectations, and why we thought TSLA stock would reach previous all-time-highs of 400. Along that path, we called […]

Market Analysis

TSLA Stock: Time for Ludicrous Mode?

One of the obvious beneficiaries of the Trump victory is Elon Musk, and TSLA. The day after Trump’s election, TSLA stock rose +12%. Traders are now pricing in even higher levels for TSLA, which has created a positive call skew. Call skews occur when traders start to price in a higher chance of upside (i.e. […]

SpotGamma for Swing Trading

You can use the information provided by SpotGamma’s TRACE tool to help you identify and execute swing trading strategies. For example, you can use the Gamma Exposure (GEX) view in TRACE to identify areas of potential price reversals. You can also use the Delta Pressure view to see where market maker hedging may be putting […]

The NVIDA Industrial Complex: 0DTE and Deteriorating Liquidity

In two recent media appearances, Brent Kochuba, Founder of SpotGamma, broke down his theory about how impactful NVDA short dated options are to the US stock market. Hint: very. First, this was discussed with Victor Jones of TasyTrade, and then with Jack Forehand of ExcessReturns. In recent market activity, we’ve seen significant movement in NVIDIA […]

SpotGamma on TraderTV Live

Brent, Founder of SpotGamma, joined trader TV live to talk about NVDA’s options driving the stock market. He also touched on the large upcoming September FOMC, VIX Expiration & Options Expiration.

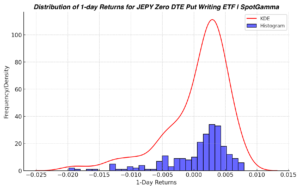

The Dangers of Premium Selling Zero DTE ETFs

Investing in Zero Days to Expiration (Zero DTE) options strategies through exchange-traded funds (ETFs) has gained popularity in recent years, particularly for investors seeking to generate income through premium selling. These ETFs, such as the Defiance S&P 500 Enhanced Options Income ETF (JEPY), employ a strategy focused on selling put options with very short expiration […]

The OPEX Effect: August 2024 | Behind the Scenes of the Recent Market Volatility

In this episode of OPEX Effect, we dive into the recent market volatility and its connection to options flows. We discuss the sudden VIX spike to 65, examining the factors that led to this extreme event, including low liquidity, the unwinding of correlation trades, and the impact of zero-day options. We explore how the market […]

Volatility, Correlation & Dispersion: SpotGamma on “The Market Huddle”

In this episode of Huddle +, Patrick Ceresna chats with Brent Kochuba, the founder of Spot Gamma, to break down the forces driving recent market volatility. They delve into the nuances of gamma and the dispersion trade, offering actionable insights for investors. Whether you’re a seasoned trader or just curious about the mechanics behind market […]

How We Nailed the Volatile Markets Last Week—And How You Can Too

How We Nailed the Volatile Markets Last Week—And How You Can Too Monday January 01 1999 Try SpotGamma HIRO Indicator for Free Real-time options data See when options drive stocks 0DTE filter for short-term trades Get Started Free Our Critical Market Guidance The past week has been a roller coaster for the stock market, with […]

Nomura on the August JPY Carry Trade/Volatility Shock

This podcast episode features a conversation with Charlie McElligott, a cross-asset macro strategist at Nomura. The discussion revolves around recent market volatility, particularly the significant selloff and shifts in volatility dynamics. McElligott explains how the flattening of the skew, a measure of demand for downside versus upside protection, and the bid on volatility of volatility […]