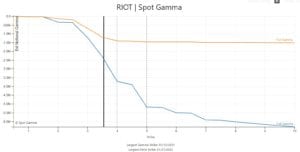

RIOT is quite interesting here as a potential bullish play. Its not a name with huge options volume, but being that its a trendy space (blockchain) and calls are low priced (retail can easily buy a bunch) we think the setup is interesting. If you note we pickup $4 strike as resistance (aka HedgeWall) and […]

call gamma

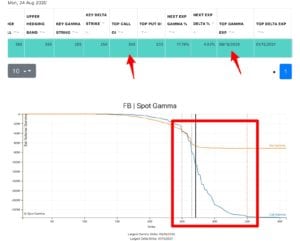

FB Making a Gamma Move?

FB has an interesting setup here as call gamma is consolidating around 265 and call open interest is building up around the 300 strike. If this call building trend continues it may cause increased volatility in the name. Volatility infers movement, which could be a rapid move higher OR lower. In this case we give […]

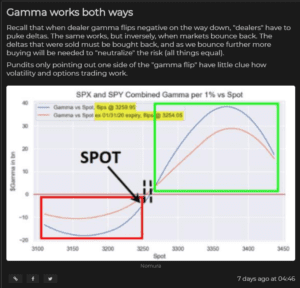

Yes, Gamma Works Both Ways

There has been quite a rally of of recent lows as the market has been digesting Coronavirus headlines. A bit over one week ago the market was testing the “zero gamma” level – which can present a challenging choice for traders. The chart below shows ES futures with our levels noted from the first week […]

Trying to Call Tops

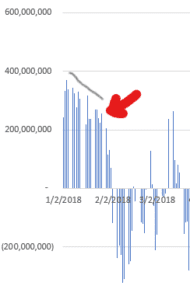

EDIT 1/28/20 : Here is an updated chart tracking this scenario. Jan 2018/Jan 2020 SPX Analogy by SpotGammaModel on TradingView.com Original Post: 1/24/20 With major moves higher over the last several months/weeks/days into January one can’t help but draw comparisons to January of 2018. We wrote an in depth review of Jan ’18 here and […]

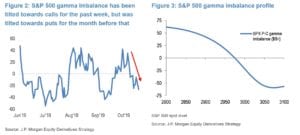

Recent JPM Gamma Analysis

JPM recently put out the following charts on S&P500 Gamma including a ratio of call gamma to put gamma which is quite interesting. It shows the amount of call gamma minus put gamma which could be interpreted in a few different ways. One way would be to look at it as how the market is […]

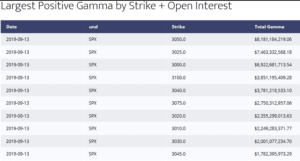

Large Options Gamma Roll 9/20/19

September 20th has a large options gamma roll ahead in the S&P500 (SPX, SPY). There are substantial call and put positions and there was obviously a lot of movement up this month. We also have the Fed which is expected to lower rates by 25 bps. This could provide a market catalyst just as large […]