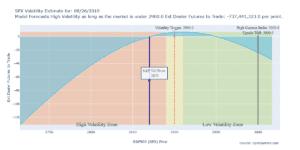

SpotGamma Model Outlook for today using a futures reference price of 2870. Dealers are short a healthy amount of gamma meaning they are going to fuel the market move at open. A short gamma position means a higher market means dealers will start buying and if the market drops at open they will sell along […]

options

FED, TRUMP, Gamma Trap: Crazy Trading Day 8/23/19

Fed gave a speech that was “volatility dampening” at 10AM. Trump didn’t like what the Fed had to say so he started tweet-trashing the Fed and China triggering a “gamma trap“. Stock markets were just at the volatility trigger level of 2920 (black horizontal line) so the gap down flipped the trigger and dealers were […]

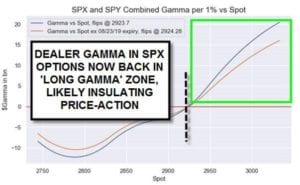

Nomuras Analyst Jumping the Gamma Gun

Nomura published an updated gamma chart showing that options dealers are now “Long Gamma…likely insulating price-action”. Nomuras options gamma estimate of 0 at 2923 is essentially the same level as our “Volatility Trigger” which is 2920. The issue with their analysis is that appears to be jumping the gun. Zero and positive are not the […]

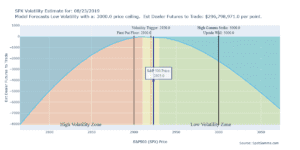

Dealers Running Out of Gas 8/16/19

After a sharp rally this morning the S&P500 stands at ~2890. This is where dealers buying starts to soften up. You can see their volume profile in the chart below. They were strong buyers up to this level but we calculated 2891 as the level where their buying wanes and 2920 where they flip to […]

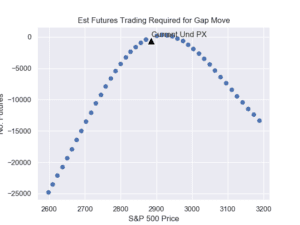

Dealer Futures Flow 8/14/19

Here is a chart estimating the futures action with the S&P500 at 2850. If markets head lower it looks like dealers will sell more futures, compounding the move down. The same works in a rally, but instead of selling those dealers will be buying. All this flips when/if the market moves over the VFLIP line […]