Today (Friday 6/5) our stock options scanner picked up a large expiration in ZM options. ZM had earnings this week and this is likely why today has such a concentrated options expiration. Based on our model, we see that there is a large amount of Delta at the 200 strike that is set to expire. […]

options expiration

Can Options Expiration Turn 2/3?

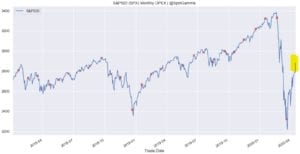

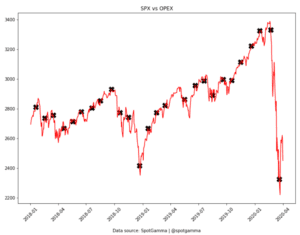

We wrote about why we think SPX Options Expiration can create volatility before (see here) and wanted to post the chart below which shows just how impactful the large monthly SPX options expiration has been the last 2 months. You can see in the chart below the February expiration was within 2 days of the […]

The Options Magnet

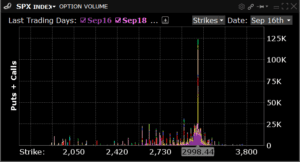

We theorize that strikes with a high amount of options gamma combined with high options volume at that strike(s) can influence the SPX to that level. This something similar to an options “pin” but we think of it more as a “magnet”. You can see in the chart below that the 2800 strike has a […]

Still Question the Impact of Options?

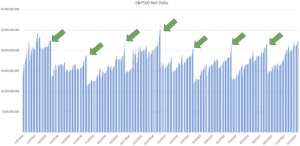

This past March monthly OPEX was one of the largest on record, and featured very large deep in the money put positions. We believed this was a key driver of market volatility in early March, and the change in markets following expiration has been drastic. March OPEX was on 3/20, and it was the following […]

Expiration Is About Deltas

Much talk focuses on options market gamma and changes in gamma around expiration. But what may be the real catalyst around OPEX is a change in deltas, not gammas. When options expiration occurs (especially a large one like December) options are closed, expire or rolled. You therefore can have large positions change, which can cause […]

Tracking Deltas on a Large Expiration

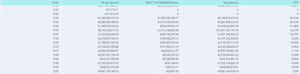

Today is an interesting setup that we’d like to document. Currently its Wednesday afternoon with Thanksgiving tomorrow. Therefore tomorrow US markets are closed and a 1/2 day Friday. We picked up on our charts a large amount of at the money (ATM)/slightly in the money ITM calls expiring on Friday at the close. You can […]

How an Option Pin Plays Out

The current October options expiration portrays how an options pin can play out. For several days we have seen 3000 as our high gamma strike, with options volume at 3000 strike dominating the market. As the market moves away from this strike options dealers and other options hedgers move the price “back in line” to […]

Option Expiration Roll Starting?

Lots of volume at the 3k strike today, but so far only about ~45k of the ~125k traded expire in the next 3 months. Our tables from last night show about 330k of total OI at the 3000 strike for September. Last months CBOE Buywrite Index strike (BXM) was 2895, so those will be deep […]

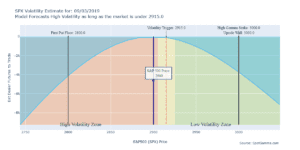

Starting Short Gamma – September Market Outlook

There are several catalysts in September that could cause the same volatility we saw in August. So far this morning there is appears that China Trade has made no headway and futures are around 2900. As you can see in the chart below that has the SPX & SPY markets starting short gamma and therefore […]