The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the AM Founder’s Note when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for SPX […]

Guest Post

Earnings Uncertainty Could Cause a Market Meltdown

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. As uncertainty ticks higher in markets, volatility tends to follow. There is a tremendous amount of doubt building in the equity markets, especially regarding corporate earnings. With the market on the cusp of earnings season, volatility may see a massive spike. […]

Trade Analysis: NQ Futures – 1 October 2021

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels and key metrics for SPX and SPY. For NQ futures, I note Gamma Notional, and […]

Trade Analysis – NQ Futures – 24 September 2021

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels and key metrics for SPX and SPY. For NQ futures, I note Gamma Notional, and […]

A Volatility Crush Is Masking An Unhealthy Stock Market

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The S&P 500 finished the week ending September 24 up a mere 50 basis points, a tranquil week – on the surface. Volatility was fierce to start the week, a dynamic predicted by SpotGamma and shared with their subscribers last week. […]

Trade Analysis: ES Futures (13 September 2021)

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for SPX […]

Trading NQ Futures Using Vanna and HIRO

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels and key metrics for SPX and SPY. For NQ futures, I note Gamma Notional, and […]

This Might Not Be a September to Remember: Options Expiration + FOMC Risk

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The September monthly options expiration, which also happens to be a quarterly quadruple witching, occurs just days before the next FOMC meeting. As noted previously, the market appears to be anxious about this upcoming meeting, and it is easy to understand why. The prospects […]

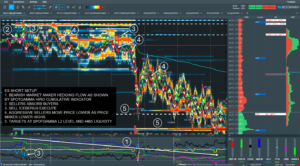

Trading ES Futures Using HIRO and Vanna

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by gathering information to help develop a thesis for the day when I trade futures. My thesis includes the following items: Directional bias Anticipated volatility Trading range for the day My primary sources of […]

Trading ES Futures Using HIRO

The following is a guest post from Doug Pless. When I trade futures, I begin my morning preparation by gathering information to help develop a thesis for the day. My thesis includes the following items: Directional bias Anticipated volatility Trading range for the day My primary source of information is the SpotGamma AM Report. For […]