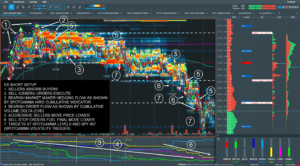

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Founder’s Note when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for […]

Market Analysis

If These Bond ETF Levels Break, You Better Buckle Up

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. There is instability in the bond market right now. In the face of a potential break, there may be a wave of volatility as market participants begin to price in changes to Fed monetary policy. Cracks are already showing as bond […]

SpotGamma on Bloomberg TV

Brent, Founder of SpotGamma, was on Bloomberg TV to discuss Fridays market selloff. Our view was that options positioning exacerbated headline risk that could result in a Santa Claus Rally. You can view that discussion here.

Trade Analysis: ES Futures (18 November 2021)

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Founder’s Note when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for […]

How ARMR Uses SpotGamma

There are many ways in which traders can use SpotGamma data to supplement their trading strategies. Here our friend Bret from The ARMR Report details his use of SG data for trade triggers.

Trade Analysis: ES Futures (11 November 2021)

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Founder’s Note when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for […]

SpotGamma Report for: 11/12/2021 PM

### You must be logged in to access this content. Don’t have an account with SpotGamma? Sign up today to view unique key levels, Founder’s Notes, market commentary, options analysis tools, and expert insights. If you’re already a SpotGamma subscriber, log in here: Username or E-mail Password Remember Me Forgot Password

From Melt-Up To Melt-Down, Why The Stock Market May Be Due For A Year-End Correction

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Investors have watched the S&P 500 rise by as much as 10% since the October 4 lows, while the NASDAQ 100 has increased by 14.5%. It has left many investors dreaming about an end-of-year melt-up for equities due to seasonal factors and the fear […]

Elon Sells. Tesla Rallies. What’s Up With That?

The News: After registering to sell shares, over the weekend, Tesla (TSLA) Inc CEO Elon Musk polled Twitter on whether to follow through. His followers voted “Yes” to him selling 10% of its stake. The Sale Process: While we are not provided the timestamps linked to the execution, you can extrapolate the timing by reviewing […]

Trade Analysis: ES Futures (5 November 2021)

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Founder’s Note when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for […]