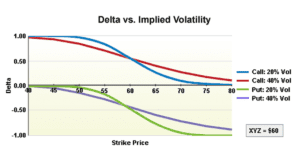

Two Greeks are increasingly mentioned as traders seek to better define the impact of the options market: Vanna and Charm. We wanted to provide some definitions and basic applications of these measurements in an effort to explain why these factors matter. This post will be seen through the lens of of an options dealer in […]

Market Analysis

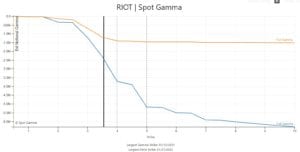

RIOT Starting

RIOT is quite interesting here as a potential bullish play. Its not a name with huge options volume, but being that its a trendy space (blockchain) and calls are low priced (retail can easily buy a bunch) we think the setup is interesting. If you note we pickup $4 strike as resistance (aka HedgeWall) and […]

MarketHuddle Podcast: Options Positions Into Elections

SpotGamma was on the Market Huddle to discuss the S&P500 options positions setup into elections. We compared it to the 2016 election, as well as December 2018 and March 2020 market crashes.

VEXING VIX

Shorting VIX has been the big pre election play, and we noted recently during market draw downs that VIX put volumes have increased. This indicates VIX sellers are taking advantage of higher VIX prices to bet on a collapse in volatility. Today we note the S&P is down ~3% and the VIX Put Call Ratio […]

Options are a Larger Piece of the Liquidity Puzzle

Aretemis posted this graphic depicting the size of the options hedging market relative to other large flows. As options volumes increase its likely that volatility increases due to the mechanics of dealer hedging. Flows have killed fundamentals US Stock Market is now the derivative of the US Options Market …. a Frankenstein monster patched together […]

Nomuras Pre Election Gamma View

“A lot of folks [are] pushing these VIX 1×2 Put Spreads trading in the market, looking to put this on as their ‘short vol’ trade expression to capture a [year-end] melt-up. Now, we see 3-month realized as the new trigger input as it is the max of the two lookback windows,” McElligott remarked Friday, noting […]

INTC Post ER

Update: We posted this to twitter last night after INTC missed earnings and was down -10% after hours. $INTC is -10% after ER’s. There is a lot of OI at 50, particularly in puts. The bulk of those positions sit in the 11/20 exp, so there could be extended pressure into low 40s. (Often in […]

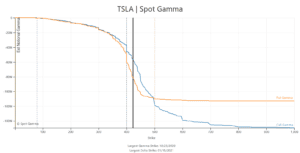

TSLA Has Less Spark

TSLA announced earnings last night which beat expectations and the stock reacted… fairly normally. No insane pops or drops. We think much of this tepid reaction is due to the relative lack of gamma compared to past earnings periods (see here). Below is a chart of the current gamma levels in TSLA, and you can […]

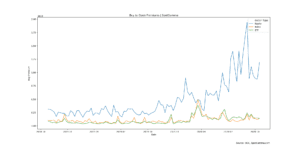

2020 The Year of the Customer Call

Fundamentals are dead Flows are the only thing that matters today Policymakers sought to stop a credit cycle with liquidity so people mistake liquidity for reality Financial gravity suspended, but not indefinitely, “flow guru” trading wins big in short term, but not long run — Christopher Cole (@vol_christopher) October 16, 2020 The 2020 markets have […]

Nomura 10/15 Gamma Update

From ZeroHedge A double-whammy of ‘soft’ Mnuchin confirmation that a fiscal “deal” pre-election is unlikely and the reacceleration of COVID-19 restrictions and closures across Europe, sparked a significant ‘risk-off’ move overnight with Nasdaq almost erasing all its gains for the week… But, as Nomura’s Charlie McElligott details, with stocks are the forefront of cross-asset risk sentiment, the talking-point on the […]