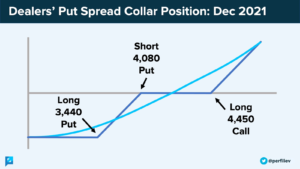

Through an options market lens, the following text will add color to some recent market movements.

CME

Poor Liquidity & Negative Gamma: Volatile Stuff

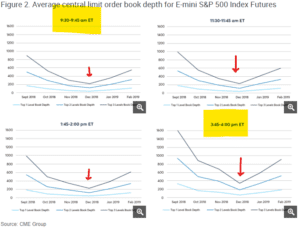

We’ve written extensively about negative gamma and poor liquidity during volatile markets, and wanted to post some of those effects in real time. ZH posted an article framing how bad liquidity in ES futures is, note the chart below: as the following chart from Deutsche Bank shows, overall liquidity for S&P500 futures has fallen to all […]

Stock Market Depth of Book: Liquidity vs Liquidity “Quality”

CME posted an interesting analysis called “Alternative Liquidity Measures” about volumes and depth of book. Their view is that liquidity doesn’t disappear during crisis times. The central argument is something along the lines of: “How can liquidity be worse if volumes skyrocket during market drops?” And that is actually a solid point. Yeah, you can […]