From ZH As the Nasdaq goes from new record to new record high day after day, passively lifting AAPL to become the world’s first $2 trillion market capitalization company, something uncomfortable is happening under the hood. While the concentration of gainers in the Nasdaq has been well-discussed… There is an increasingly ominous major (bearish) divergence […]

gamma

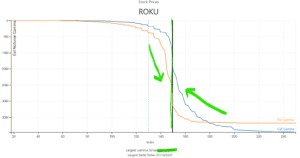

ROKU Analysis 8/14/20

ROKU has an interesting setup day, as we show ~43% of options gamma is expiring today. Most of the options in ROKU are also at the 150 strike, which may setup an interesting “pin” play. The idea here is thats the options decay hedging flows (which are tied to 150) push the stock back towards […]

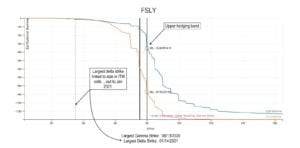

FSLY Stock Analysis

This was a great chart posted by our friend @ccurvetrading of FSLY stock based on our options data. You’ll note there was a lot of gamma put gamma set to expire today (8/13) which would be crushed if the stock started a move higher. This may have caused dealers to rapidly cover short hedges. We […]

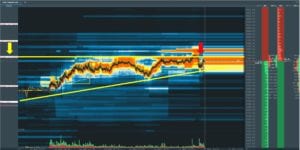

Gamma Level Resistance – A Visualization

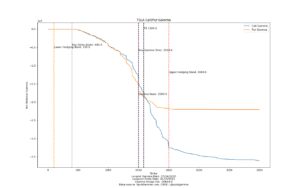

Today provided an excellent example of key resistance at an important options level in the SPX/ES. As you can see the market had a consistent bid from the open right into our 3387 SPX level (yellow arrow, left). The market spend much of the afternoon up against that resistance area, and finally rejected it towards […]

Silver SLV Gamma Volatility

Silver and the SLV ETF are having some amazing volatility as of late, with a -10% move currently underway. We’ve been watching this setup for several weeks, anticipating volatility due to the large amount of call gamma building up. We believe its important to be aware of this position as these very large moves may […]

Nomura August 2020 Gamma Update

Charlie McElligott’s prediction from last week that the Nasdaq could suffer from a nasty spill as dealer gamma had turned increasingly negative… … was foiled by the blockbuster earnings from the mega tech companies which sent the Nasdaq to new all time highs, forcing dealers – and frankly everybody else – to chase the year’s best performing […]

Nomura Gamma Update 7/23/20

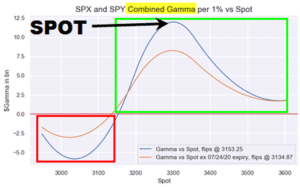

From ZH: Indeed, according to Nomura quant Charlie McElligott, after last month’s near-record Op-Ex, things are far more calm now and “3300 looks like the truth in Spooz, with nearly double the aggregate $Gamma ($4.5B) of the next closest line (3250 with $2.4B) as we head into expiry, thus exhibiting some “gravity” with Spooz up nearly 90 […]

TSLA Options Pre Earnings

TSLA reports earnings tonight, and there is a ton of options gamma to generate a large move tomorrow. We define key levels for the stock as follows: Lots of Gamma at 1500 – thats the “pivot” area where stock remains a bull above, bear below. There are a ton of in the money calls at […]

Goldman: All You Ever Wanted To Know About Gamma, Op-Ex, And Option-Driven Equity Flows

From ZeroHedge: In our daily observations of (bizarre) market moves (usually in the context of comments from Nomura’s Charlie McElligott and Masanari Takada), we frequently analyze the delta-hedging of option positions by dealers, i.e. gamma, which for a variety of reasons has emerged as one of the dominant drivers of risk assets (at least until […]

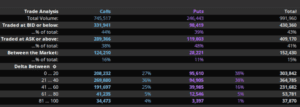

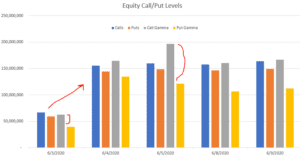

Equity Call Euphoria & OPEX Concentration

We have been reviewing the last 5 days of options data in light of reports showing record levels of call positions. Seen below you can see that call volumes have exceeded those of February 2020 – something we felt helped lead to the large drop in March. As you can see below our data suggests […]