From ZH Update (1000ET): It appears the unclenching has begun! * * * While the S&P has been weaker since Friday’s opex, Nasdaq is the “messiest” due to the index-level price-movement “unclenching” based upon the sheer amount of $Gamma running-off post last Friday’s Op-Ex. As Nomura’s Charlie McElligott notes, the effect was particularly notable in […]

nomura

Nomura’s McElligott: ‘The VIX Is Broken — Again’

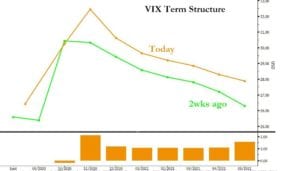

From Heisneberg: “From a Vol market perspective, the issue is that the VIX is broken — again,” Nomura’s Charlie McElligott said Monday, in one section of a sweeping note documenting recent dynamics and detailing what a trio of backtests might foretell for markets on the heels of last week’s somewhat deranged developments. It’s “all demand” […]

“Hard Purge” – Nomura Warns The Vol Market Signals Risk Of “Outright Crash Down”

From ZH As we detailed earlier, futures were down quite sharply to start the overnight session only to stage a significant recovery to current highs (perhaps on the back of a lack of glaring clearing issues… for now… appearing over the weekend). However, as SpotGamma notes, despite this move higher the options structure deteriorated, and we will […]

1/20/20 Nomura Update

From ZH: Earlier today we discussed last week’s “very large” options expiration, which as SpotGamma calculated sparked a ~50% reduction in single stock gamma, which on one hand has left markets vulnerable to short-term volatility but on the other – as Nomura’s Charlie McElligott poetically put it – sparked a “gamma unchlenching” as evidenced by […]

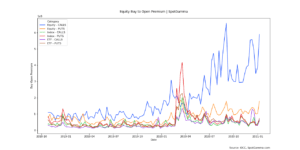

“Full-Tilt Insanity Mode” – Nomura Warns This Week’s OpEx Is “Absolutely Going To Matter” For ‘Weaponized Gamma’ Crowd

Via ZeroHedge The world appears to be stock in what Nomura’s Charlie McElligott calls “Robinhood / YOLO / ‘weaponized gamma’” nonsense as the equity buy-to-open premium is soaring in individual stocks (and indices)… Source: SpotGamma Specifically, the Nomura MD notes that it is Op-Ex week, and the options positioning is absolutely going to matter, particularly off the back of […]

Nomura + SpotGamma – 2.5 Trillion Reasons To Care About This Week’s ‘Quad Witch’ Options Expiration

2.5 Trillion Reasons To Care About This Week’s ‘Quad Witch’ Options Expiration From ZeroHedge:Tue, 12/15/2020 – 11:55 Like all December option expirations, this month’s is large, with $2.5tln of SPX-linked options notional (linked to 8% of the S&P’s market cap) expiring on 18-Dec, but for a December, it is not extreme… Nomura’s Charlie McElligott notes […]

Nomura Uses Our “Weaponized Gamma” Phrase

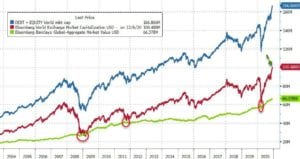

It was SpotGamma that coined the phrase “weaponized gamma” which Nomura uses to describe the current call mania. Read more from our September 8, 2020 post, “No, Softbank Didn’t Weaponize Options Gamma.” From ZeroHedge: The ongoing meltup in stock markets lifted global market caps above $100 trillion for the first time in history yesterday… Source: […]

Nomura 10/15 Gamma Update

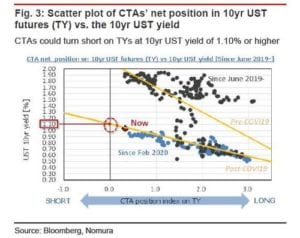

From ZeroHedge A double-whammy of ‘soft’ Mnuchin confirmation that a fiscal “deal” pre-election is unlikely and the reacceleration of COVID-19 restrictions and closures across Europe, sparked a significant ‘risk-off’ move overnight with Nasdaq almost erasing all its gains for the week… But, as Nomura’s Charlie McElligott details, with stocks are the forefront of cross-asset risk sentiment, the talking-point on the […]

Nasdaq Explodes Higher Amid Unprecedented Gamma/Futures Double-Squeeze

From ZeroHedge Heading into the weekend, we observed that despite the recent drift higher in the Nasdaq last week after its September correction, institutional investors remained skeptical with a near-record number of non-commercial spec shorts in the Nasdaq 100 mini according to the latest CFTC Commitment of Traders report, and after spiking to a historic […]

Nomura Gamma 9/29/30

From ZeroHedge While JPMorgan could not agree last week if the month-end pension and fund flows (which according to one JPM quant at $200bn would be the largest forced selling since March, and according to another would be a “tailwind” for equities) would be positive or negative for stocks, one look at market gamma suggests that contrary […]