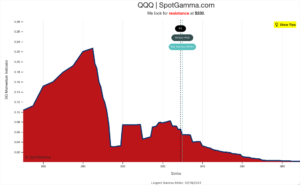

The following is a guest post from Doug Pless. At SpotGamma, our community uses the SpotGamma AM Founder’s Note when preparing to trade index products such as the QQQ (Nasdaq 100 ETF). Specific levels to note include the following: Volatility Trigger, SpotGamma Absolute Gamma Strike, Put Wall, and Call Wall. Additional levels are the CP […]

QQQ

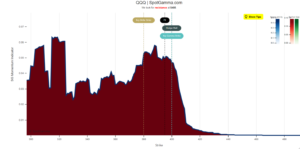

Gamma Levels Can Reveal Huge Forces Driving The Nasdaq

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The equity markets have had sharp drawdowns and extremely high volatility in 2022. While this dynamic has created a difficult backdrop for traders, the options market is playing a big role during these tricky times and SpotGamma indicators may provide an […]

The Sell-off For The NASDAQ May Not Be Over Yet

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. With the Fed pivoting to a very hawkish stance starting in 2022, the Nasdaq has witnessed a dramatic decline of nearly 18% since peaking in November. The drop may only continue in the weeks ahead as market participants try to figure out the potential […]

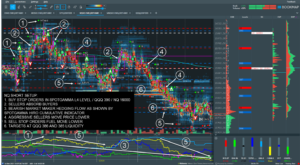

Trade Analysis: NQ Futures (14 December 2021)

The following is a guest post from Doug Pless. When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For NQ futures, I note Gamma Notional, and the Volatility Trigger, Put Wall, and Call Wall gamma levels for QQQ. I also look up QQQ in Equity Hub. […]

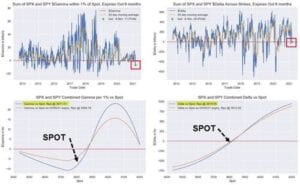

From Melt-Up To Melt-Down, Why The Stock Market May Be Due For A Year-End Correction

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Investors have watched the S&P 500 rise by as much as 10% since the October 4 lows, while the NASDAQ 100 has increased by 14.5%. It has left many investors dreaming about an end-of-year melt-up for equities due to seasonal factors and the fear […]

Trading NQ Futures Using QQQ Equity Hub Data and Vanna Model

The following is a guest post from Doug Pless. As discussed previously, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels and key metrics for SPX and SPY. For NQ futures, I note Gamma Notional, and the Volatility Trigger, Put […]

Nomura: “Max Short Gamma” Pain… But Relief Is Coming

Via ZH: Earlier this week we pointed out a bizarre divergence in the “greeks” – while the Nasdaq had slumped into negative gamma territory, which is where dealers are forced to sell more as the Nasdaq slides lower creating a feedback loop where selling begets selling, even as the S&P still remained in positive gamma […]