The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Founder’s Note when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for […]

volatility

Trade Analysis: ES Futures (12 October 2021)

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Founder’s Note when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for […]

Earnings Uncertainty Could Cause a Market Meltdown

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. As uncertainty ticks higher in markets, volatility tends to follow. There is a tremendous amount of doubt building in the equity markets, especially regarding corporate earnings. With the market on the cusp of earnings season, volatility may see a massive spike. […]

A Volatility Crush Is Masking An Unhealthy Stock Market

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The S&P 500 finished the week ending September 24 up a mere 50 basis points, a tranquil week – on the surface. Volatility was fierce to start the week, a dynamic predicted by SpotGamma and shared with their subscribers last week. […]

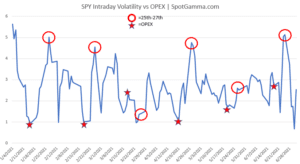

S&P500 Is Less Volatile Into Expiration

In our daily subscriber reports we often talk about the “Options Expiration [OPEX] Cycle” and its influence on the S&P500. This cycle starts on the third Friday of each month, wherein its typical to have >20% of total S&P500 options* expiring. Our view is that options market maker hedging begins to concentrate around the strikes […]

Can Options Expiration Turn 2/3?

We wrote about why we think SPX Options Expiration can create volatility before (see here) and wanted to post the chart below which shows just how impactful the large monthly SPX options expiration has been the last 2 months. You can see in the chart below the February expiration was within 2 days of the […]

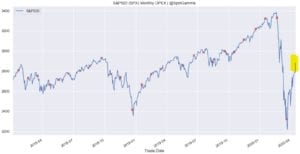

The Case for Reduced Price Volatility

Our current view of markets is that we should see reduced price volatility following the large March expiration that took place this past Friday (3/20). One of the features of this expiration was a large number of in the money puts, which possibly created several billion in deltas for options dealers to hedge. As dealers […]

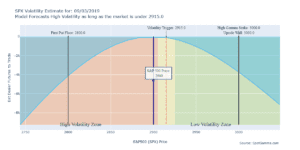

The Theory Behind Put Walls

For this example, 2900 in the S&P500 is identified as a strike with large put interest in SPX options. The theory behind Put Walls: We make an assumption that most of those puts were bought by hedgers, therefore market makers and dealers are short those 2900 puts. As a result they must short sell stock […]

Starting Short Gamma – September Market Outlook

There are several catalysts in September that could cause the same volatility we saw in August. So far this morning there is appears that China Trade has made no headway and futures are around 2900. As you can see in the chart below that has the SPX & SPY markets starting short gamma and therefore […]

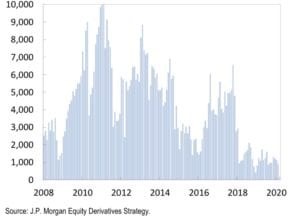

Nomura: Volatility Crush Market Options Gamma on CNBC

Nomura analyst on CNBC discussing how dealer gamma effects the equity market. He mentions the large open interest in the VIX (“50 Cent”) and how a volatility crush could spur an equity rally. This is because (as seen through the SpotGamma model) a drop in volatility forces dealers to rehedge through buying stocks. As the […]