Options flows blocking a market breakout Monday January 01 1999 Try SpotGamma HIRO Indicator for Free Real-time options data See when options drive stocks 0DTE filter for short-term trades Get Started Free Subscribe to the industry’s #1 platform delivering daily expert analysis to unveil: Proprietary market levels Bullish or bearish stocks Hidden trading risks Get […]

Guest Post

Trade Analysis: ES Futures (September 19, 2022, Post-Expiration Monday)

The following is a guest post from Doug Pless. Preparation When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For ES futures, I note key Gamma levels for SPX and SPY, the SpotGamma Imp. 1 Day Move for SPX, the SpotGamma Gamma Index and Gamma Notional […]

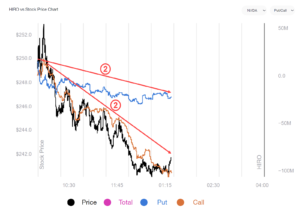

Trade Analysis: QQQ (August 15, 2022)

The following is a guest post from Doug Pless. At SpotGamma, our community uses the SpotGamma AM Founder’s Note when preparing to trade index products such as the QQQ (Nasdaq 100 ETF). Specific levels to note include the following: Volatility Trigger, SpotGamma Absolute Gamma Strike, Put Wall, and Call Wall. Additional levels are the CP […]

Trade Analysis: NVDA (July 20, 2022)

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, Key Delta Strike, and other metrics for each stock and compare the values with the previous […]

Gamma Levels Can Reveal Huge Forces Driving The Nasdaq

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The equity markets have had sharp drawdowns and extremely high volatility in 2022. While this dynamic has created a difficult backdrop for traders, the options market is playing a big role during these tricky times and SpotGamma indicators may provide an […]

The Oversold Stock Market Could See a Bounce

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The S&P 500 has fallen by more than 10% in the past two weeks, and to say that it is due for a bounce may be an understatement. The combination of a 75 bps Fed rate hike and massive June quarterly options expiration resulted […]

Trade Analysis: TSLA (June 17, 2022)

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, Key Delta Strike, and other metrics for each stock and compare the values with the previous […]

Will The Fed Push Stocks Over The Edge Next Week?

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Hard Landing Worries Are Driving Volatility Volatility in the market has been high as traders and investors look to hedge risks associated with the Fed and the potential for an economic slowdown. The concerns seemed to evolve, starting with inflation and growth worries. Now […]

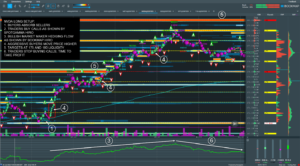

Trading Stock Using Equity Hub and HIRO

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, and other metrics and compare the values with the previous values for the last five days. […]

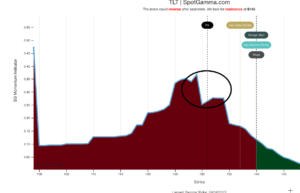

The TLT’s Recent Plunge May Be Over

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Bond yields have soared in 2022, sending ETFs like the iShares 20+ Year Treasury Bond ETF (TLT) lower by around 10%, but almost 25% off its 2020 highs. The ETF now comes to a critical juncture, signaling rates pushing significantly higher […]