Because of this OIL/VXX may start trading significantly above their asset based IV price. Likely will become very difficult to short these products & without shares to short Authorized Participants can’t do arbitrage operations they typical run to drive price down to IV Price. https://t.co/1lacpxhnVf — Vance Harwood (@6_Figure_Invest) March 14, 2022 From BusinessWire: Barclays […]

Market Analysis

Brent Calls for Market Rally Ahead of March OPEX on the Contrarian Investor Podcast

Brent, Founder of SpotGamma, was on the Contrarian Investor Podcast this week. There he discussed how options hedging may impact stock prices, and why he thinks markets may rally into next weeks options expiration (3/18/22). For full audio-only, go here to listen.

HIRO In Action: COIN

Today we noted strong call buying to start the day in COIN (Coinbase). This call buying is shown below, in orange, in the form of estimated hedging impact. The hedging impact, or HIRO signal, is tied to the right Y axis. The signal suggests that as traders buy calls, market makers are likely selling those […]

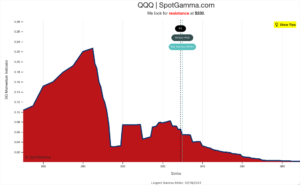

The Sell-off For The NASDAQ May Not Be Over Yet

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. With the Fed pivoting to a very hawkish stance starting in 2022, the Nasdaq has witnessed a dramatic decline of nearly 18% since peaking in November. The drop may only continue in the weeks ahead as market participants try to figure out the potential […]

Put Sellers & The Incredible Feb 24th Intraday Reversal

On Thursday 2/24 the market opened down nearly 2.5% on news that Russia had invaded Ukraine. Off of that opening low, the S&P500 staged a remarkable 4% intraday rally, moving from a low of 4114 to a high of 4294. So, what caused this rally? Short covering. Below we’ve posted our HIRO chart of SPY […]

Trade Analysis: ES Futures (7 February 2022)

The following is a guest post from Doug Pless. When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for SPX and SPY. I also look up […]

Debating the SEC on the Role of Options in the GME Squeeze

SpotGamma was involved with a top-tier group that reviewed the SEC’s report on the role of options in the January ’21 GME squeeze. Immediately following the release of the October ’21 SEC report, we also released a video explaining why we viewed options as a key driver of the January ’21 GME move. This new […]

SpotGamma On Risk.net: Vanna and the Big Put: unusual suspects in a market mystery

By mid-January, investors had built $120 billion of net positive delta inthe US options market, says Brent Kochuba, founder of SpotGamma, aprovider of options analytics. “The market went up a lot in 2021, so anyof these call positions, which had been sitting there for a while, grew tobe a very large notional value.”As the market […]

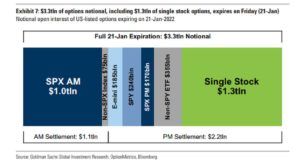

After Historic Stock Market Reversal, SpotGamma Calls Arrival at Lower Bound

Market Activity: Monday featured an historic stock market reversal wherein the S&P open down 1.5%, declined another 2.5% intraday, then rallied 4% into the close. Two weeks ago we flagged the January 21st options expiration as a catalyst for volatility, and we viewed Monday as a continued “clearing” of large OPEX hedges. Market Backdrop: In […]

SpotGamma on Bloomberg

“Brent Kochuba, founder of analytic service SpotGamma, observed that last week and earlier this week, the existence of many large in-the-money single-stock call positions had led to a large positive delta skew — the theoretical value of stock required for market makers to hedge the directional exposure resulting from all options activity. As most of […]