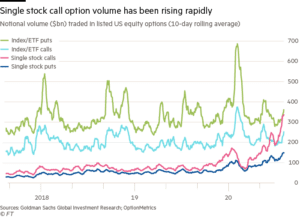

From the FT Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.comT&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article […]

Market Analysis

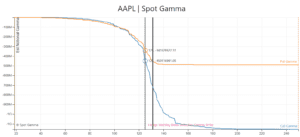

AAPL Options Gamma Unwind

It’s September 3, 2020 and parts of the market crashed. Let’s start with AAPL.

Nomura Gamma Crash Up

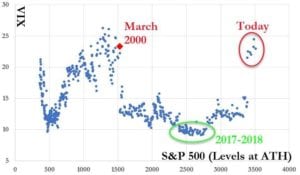

From ZH On Saturday, when we published our lengthy compendium of bizarro market charts showing the paradoxical melt up in both risk assets and the VIX, leading to the most positive correlation between the S&P and the VIX since the Feb 2018 Volmageddon event… … we said that “one reason why no conventional indicator seem to matter […]

AAPL Options Insanity

From ZH And since nothing else has changed and we already showed what is going on from a delta- and gamma-hedging perspective… … we will give the last word to the Bear-Traps report which describes the “Insanity” in Apple Options: The convexity skew picture on big-name equities like Apple $AAPL has gone parabolically stupid. Let’s keep this […]

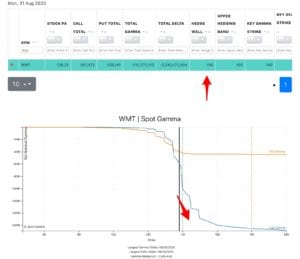

WMT Options Gamma Trap

WMT is trading over 5% higher today be in on rumors of new services, or possibly buying TikToc. Doesnt matter. Whats interesting is there are a LOT of call options sitting >=140 strike, with another 240k calls trading so far today. Its 11AM EST. It appears the gamma could fuel a move up toward $160, […]

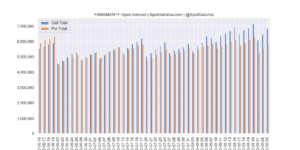

FANGMAN+T Call vs Put Interest

In June we saw put interest leading in the top tech names, but over the past two months we’ve see call open interest gap well over put open interest.

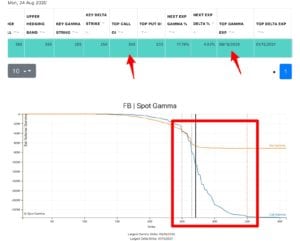

FB Making a Gamma Move?

FB has an interesting setup here as call gamma is consolidating around 265 and call open interest is building up around the 300 strike. If this call building trend continues it may cause increased volatility in the name. Volatility infers movement, which could be a rapid move higher OR lower. In this case we give […]

Nomura August “Extreme Gamma”

From ZH As the Nasdaq goes from new record to new record high day after day, passively lifting AAPL to become the world’s first $2 trillion market capitalization company, something uncomfortable is happening under the hood. While the concentration of gainers in the Nasdaq has been well-discussed… There is an increasingly ominous major (bearish) divergence […]

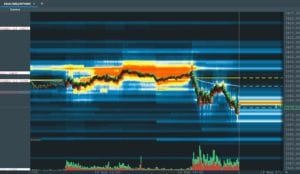

Futures, Options and Liquidity.

We’ve been marking 3400 as a large gamma area for several days, and you can see from our morning data that the 3400 area was again key today. Our levels are listed above, left in the Bookmap column. You can also see dark red areas in the center of the chart which denotes bid/ask liquidity, […]

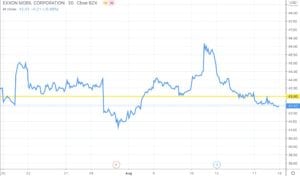

XOM Balanced Options Position

A member requested analysis of XOM which you can see below. It appears the gamma has sort of a “straight jacket” on XOM with large put interest at 40, large call interest at 50. Our Hedge Wall picks up a change in hedging behavior at 43, which indicates that’s a key level in the stock. […]