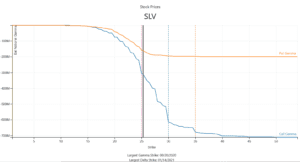

Below is our most recent data for SLV (silver ETF) going into Fridays August options expiration. Call option positions remain at or near the highs we’ve seen over the last several weeks. There is a large concentration of options at the 25 and 30 strikes which presents an interesting setup. If SLV can charge ahead […]

Market Analysis

S&P 500 Double Top

Its interesting too look back at where we were in February ’20 just days before the crash. Clearly things are different now, and we are suggesting a >30% drawdown (for one, the put fuel isn’t there). However its interesting to compare sentiment and data particularly as we have hit a double top just before a […]

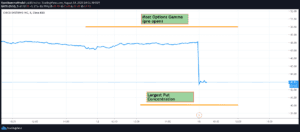

PRPL Mattress Fire – Options IV Burn

PRPL is a major retail WallStreetBets favorite, causing a huge runup in to 8/13 earnings. After reporting an ER beat the IV in the stock likely got crushed, which caused long OTM calls to decline sharply. This leads to dealers unwinding hedges, and a stock drop.

WKHS Options Pin 8/14/20

WKHS seemed pinned to $15 where we mark a large amount of options gamma.

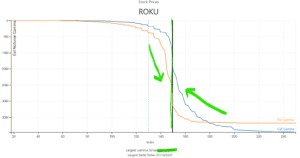

ROKU Analysis 8/14/20

ROKU has an interesting setup day, as we show ~43% of options gamma is expiring today. Most of the options in ROKU are also at the 150 strike, which may setup an interesting “pin” play. The idea here is thats the options decay hedging flows (which are tied to 150) push the stock back towards […]

SLV Update 8/14/20

We’ve been tracking SLV & Silver closely for several weeks now. Originally there were many Jan ’21 calls struck at 20, but those have largely been either closed or rolled, such that 25 is now the key strike. Much of the gamma in SLV expires next Friday 8/21 which could add a short term dynamic […]

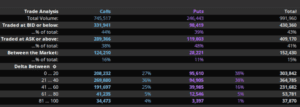

CSCO Earnings Crash – a Prediction

We’re positing up a live example of using our Equity Hub data. CSCO disappointed in earnings today, and is currently down 10%. Here is a snapshot of our data from preopen which shows the largest concentration of options at the 50 strike. The most puts are at 40, which we think might function as a […]

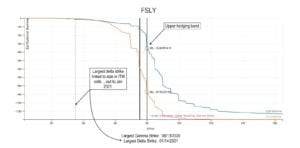

FSLY Stock Analysis

This was a great chart posted by our friend @ccurvetrading of FSLY stock based on our options data. You’ll note there was a lot of gamma put gamma set to expire today (8/13) which would be crushed if the stock started a move higher. This may have caused dealers to rapidly cover short hedges. We […]

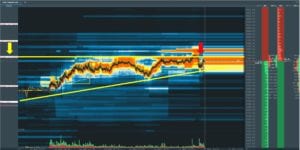

Gamma Level Resistance – A Visualization

Today provided an excellent example of key resistance at an important options level in the SPX/ES. As you can see the market had a consistent bid from the open right into our 3387 SPX level (yellow arrow, left). The market spend much of the afternoon up against that resistance area, and finally rejected it towards […]

Silver SLV Gamma Volatility

Silver and the SLV ETF are having some amazing volatility as of late, with a -10% move currently underway. We’ve been watching this setup for several weeks, anticipating volatility due to the large amount of call gamma building up. We believe its important to be aware of this position as these very large moves may […]