TSLA has been on an incredible +50% move for the month following the 11/6 elections. SpotGamma wrote extensively about the very bullish setup we saw on 11/7 – a setup that was more bullish than general market expectations, and why we thought TSLA stock would reach previous all-time-highs of 400. Along that path, we called […]

charm

‘Call AAA’: Santa Claus Is Having Sleigh Troubles

Through an options market lens, the following text will add color to some recent market movements.

How Changes in Implied Volatility Pushes Markets Around (aka the Vanna Trade)

Brent, Founder of SpotGamma, explains how the “Vanna Trade” works. As implied volatility changes, options dealers may have to adjust their hedges. Brent explains how this hedging flow can create large rallies or selloffs in markets. He also touches on the topic of charm, or the change in hedging delta due to time decay.

When YOLO goes “YOL-Oh No!”

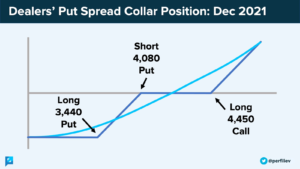

Summary: Issue: SpotGamma believes that current markets reflect a great amount of risk and face the prospect of a violent drawdown. This is due to the following: Hedging: Low levels of options-based hedging. Short-Selling: Low levels of stock shorting. Speculation: High levels of margin used to buy stocks. Remedies: SpotGamma levels continue to be […]