Using Options to Evaluate Rate-Sensitive Names With last week bringing realized volatility to the highest levels seen in 6 months, the market has entered a highly reactive state. Market events and data releases each have the potential to change the outlook for direction and volatility—and the December 10 FOMC remains the biggest date on the […]

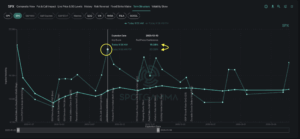

Equity Hub

Crypto Winter or Santa Claus Rally: Which Comes Next?

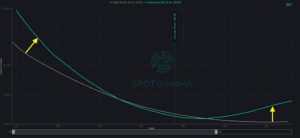

Evaluating IBIT with Positional Analysis Crypto markets have faced serious selling pressure this past month, and last Friday’s sharp decline pushed Bitcoin to yearly lows near $80K. BTC is now on track for its worst monthly performance since 2022—down 22% over the past month and negative for the year. Using Positional Analysis, we can examine […]

Trade Analysis: ES Futures (September 19, 2022, Post-Expiration Monday)

The following is a guest post from Doug Pless. Preparation When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For ES futures, I note key Gamma levels for SPX and SPY, the SpotGamma Imp. 1 Day Move for SPX, the SpotGamma Gamma Index and Gamma Notional […]

Trade Analysis: NVDA (July 20, 2022)

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, Key Delta Strike, and other metrics for each stock and compare the values with the previous […]

Trade Analysis: TSLA (June 17, 2022)

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, Key Delta Strike, and other metrics for each stock and compare the values with the previous […]

Trade Analysis: AMD (May 26, 2022)

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, and other metrics and compare the values with the previous values for the last five days. […]

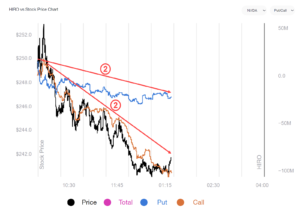

Trading Stock Using Equity Hub and HIRO

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, and other metrics and compare the values with the previous values for the last five days. […]

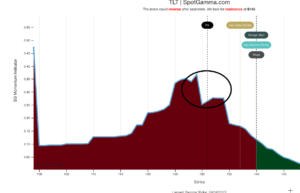

The TLT’s Recent Plunge May Be Over

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Bond yields have soared in 2022, sending ETFs like the iShares 20+ Year Treasury Bond ETF (TLT) lower by around 10%, but almost 25% off its 2020 highs. The ETF now comes to a critical juncture, signaling rates pushing significantly higher […]

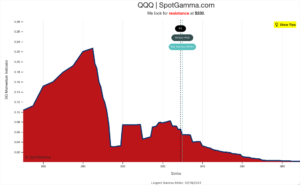

The Sell-off For The NASDAQ May Not Be Over Yet

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. With the Fed pivoting to a very hawkish stance starting in 2022, the Nasdaq has witnessed a dramatic decline of nearly 18% since peaking in November. The drop may only continue in the weeks ahead as market participants try to figure out the potential […]

Trade Analysis: ES Futures (7 February 2022)

The following is a guest post from Doug Pless. When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for SPX and SPY. I also look up […]