How Gamma, Options Flow, and Volatility Signals from SpotGamma Unlocked a High-Conviction Tesla Trade On September 11, Tesla delivered a textbook options‑driven breakout — and SpotGamma traders were positioned for it before the move accelerated. What began as a high‑probability intraday setup quickly turned into a longer‑term opportunity, producing a 10:1 reward‑to‑risk intraday trade while […]

TSLA

Tesla Breaks Gamma Pin Leading To Precision Intraday Short

When a stock is pinned to a major gamma level, the real opportunity often comes when it finally breaks free. In this case study, Doug Pless walks through a high‑conviction intraday short in Tesla (TSLA) that unfolded after price failed at the Key Gamma Strike and volatility expanded exactly as SpotGamma’s models projected. Using a […]

TSLA 420: A Temporary High (?) as Charm & Vanna Flows Work Against the Stock

TSLA has been on an incredible +50% move for the month following the 11/6 elections. SpotGamma wrote extensively about the very bullish setup we saw on 11/7 – a setup that was more bullish than general market expectations, and why we thought TSLA stock would reach previous all-time-highs of 400. Along that path, we called […]

TSLA Volatility Falling Despite Being Down 10%

TSLA is down 10% after earnings, and our data is suggesting that if anything, TSLA options are now cheap! One would think that may lead to an increase in options implied volatility, as the implied move was just 6%. You can see this in the legend in our earnings dashboard, below. This shows us the […]

Trade Analysis: TSLA (June 17, 2022)

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, Key Delta Strike, and other metrics for each stock and compare the values with the previous […]

Elon Musk’s Margin Call? The TWTR Loan.

TSLA Shares were down 12% yesterday – one of its largest 1 days selloffs ever. While the overall market was down too, the pressure on TSLA was exceptional. Why? In an SEC filing loan terms were announced for Elon’s TWTR takeover bid. It seems Elon is borrowing up to $12.5 billion, and using TSLA stock […]

Trading Stocks With SpotGamma and Bookmap HIRO

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, and other metrics and compare the values with the previous values for the last five days. […]

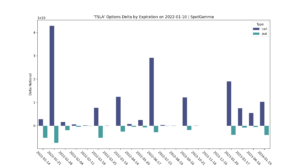

January OPEX: TSLA Tracking

SpotGamma has detected a large amount of call options expiring this Friday in many single stocks (see here). The stock with the largest size (on a delta basis) expiring is TSLA. As such, we’ve setup this page to track the daily change in TSLA’s delta position, to monitor what any options impact may be. In […]

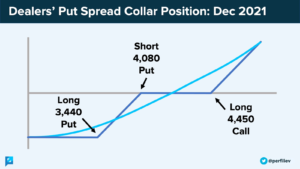

‘Call AAA’: Santa Claus Is Having Sleigh Troubles

Through an options market lens, the following text will add color to some recent market movements.

SpotGamma TDAmeritrade Appearance

Tesla (TSLA) Stock Hit All-Time Highs, Options Volume & Open Interest What can the Tesla (TSLA) options volume and open interest tell investors about its stock price moving forward? Brent Kochuba says that TSLA is the reverse of PTON as the stock keeps moving higher. Some of the recent trading trends include more options activity […]