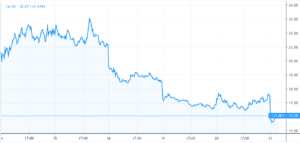

From Heisneberg: “From a Vol market perspective, the issue is that the VIX is broken — again,” Nomura’s Charlie McElligott said Monday, in one section of a sweeping note documenting recent dynamics and detailing what a trio of backtests might foretell for markets on the heels of last week’s somewhat deranged developments. It’s “all demand” […]

VIX

“Full-Tilt Insanity Mode” – Nomura Warns This Week’s OpEx Is “Absolutely Going To Matter” For ‘Weaponized Gamma’ Crowd

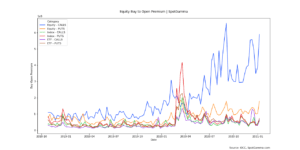

Via ZeroHedge The world appears to be stock in what Nomura’s Charlie McElligott calls “Robinhood / YOLO / ‘weaponized gamma’” nonsense as the equity buy-to-open premium is soaring in individual stocks (and indices)… Source: SpotGamma Specifically, the Nomura MD notes that it is Op-Ex week, and the options positioning is absolutely going to matter, particularly off the back of […]

VEXING VIX

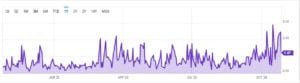

Shorting VIX has been the big pre election play, and we noted recently during market draw downs that VIX put volumes have increased. This indicates VIX sellers are taking advantage of higher VIX prices to bet on a collapse in volatility. Today we note the S&P is down ~3% and the VIX Put Call Ratio […]

Morgan Stanley VIX & SPX Market Gamma Update

From Zerohedge we see some nice Gamma related research from Morgan Stanley. Posted below is their note. By Chris Metli of Morgan Stanley Quantitative Derivative Solutions The March 2020 equity selloff ushered a huge volatility shock that caused unprecedented losses for short volatility strategies. The impact is likely bigger than just a one-time hit to […]

Strike of the Deltas – Can Put Deltas Move the Market Down?

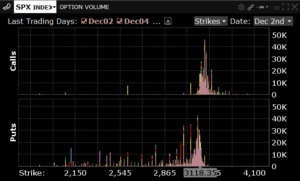

Interesting day in the market today as numerous China related headlines took away a futures rally that was testing all time highs. Its our view that much of the selling today was due to put buying. It seems there was a decent amount of slightly OTM puts trading, combined with a large move up in […]

Has Gamma Made the VIX “Useless”

Posting this as something to revisit later. Zerohedge posted the following recently: If one observes a conventional indicator of prevailing risk sentiment such as the VIX, which is trading in the low teens and near the lowest levels over the past two years (and far below its long-term average of 20), one would be left […]

Gamma Driven VIX Drop

There was quite a large move down in the VIX overnight (8/20/19) and Nomura claims that was due in part to the gamma around a large VIX position. This gamma driven VIX drop is apparently related to hedging around a large VIX position. When options decay this can effect the amount of hedging that a […]

JPM Liquidity Rates & VIX Correlation

JPM says that liquidity disappears as VIX spikes. This seems to make intuitive sense. The fact that the VIX is higher means the market is pricing in larger moves which means dealers don’t want to get stuffed with large trades as the market rips through them. This chart doesn’t tell us what level this depth […]