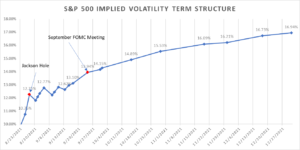

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Jay Powell will speak at next week’s Jackson Hole Economic Symposium. Some investors think it may be where he lays out the Fed’s path towards the tapering of asset purchases. Recent economic data suggests that inflation is running at levels that […]

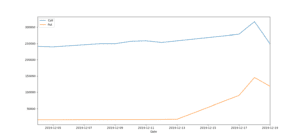

open interest

Speculators, Gamblers, Unite!

A strange thing has been happening in the options market recently, and I believe that is driving a lot of the intraday volatility we have been seeing. Yesterday (5/27) for instance, the S&P500 Index moved just under 100 total handles on the day. Take a look at the end of day snapshot of put volume […]

Attack of Risk Reversal

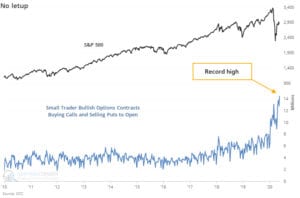

@SentimentTrader posted this chart showing record “small” positions in long calls and short puts. Sentiment says these are “10 contracts or fewer per trade”, insinuating retail traders. This type of trade (long call/short put) is a position also known as a risk reversal. While the traders are not likely actually trading short puts and long […]

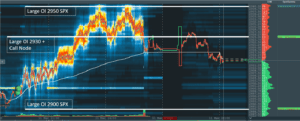

SPX Options Levels & ES Futures Trading

We believe that strikes with high open interest in the SPX create support and resistance lines for ES Futures trading. Here is one prime example. At top is the morning note we sent to subscribers at at the bottom you see those levels noted in the Bookmap futures trading platform. Futures currently trade at a […]

Is Nomura Reading SpotGamma Notes?

No, I’m sure they arent. But there are a lot of overlap. From our recent subscriber notes: 2950 should now set up as the High Gamma strike resistance with 2900 the first line of support. As we are in positive gamma territory we see decreased risk of a sharp sustained drop from this level – […]

The Option Pin / Sticky Strike

Friday (4/3/20) was an interesting day in the S&P500 market due to its rotating action around the 2500 strike. We had several data points that led us to believe that this strike would be key to the action on Friday and wanted to highlight those points. Most of these charts are only available to subscribers […]

Corona Market: Reviewing Right Tail Risk

This is being written just before the 3/26 unemployment data release which is forecasting as much as 2 million unemployment due to the economic shutdown related to Coronavirus. There is also a Stimulus Bill “pending“. While we are all aware of the downside risks here, here is a scenario for a major move to the […]

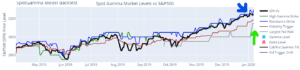

Possible Gamma Flip Setup 1/7/2020

We’ve been tracking very high levels of call gamma the last several weeks that has recently stalled as we’ve hit heavy resistance around 3250 (blue arrow in chart below). During the last several days the zero gamma flip point has moved higher to ~3185 as you can see (green arrow): Iran has started launching missiles, […]

Options Model Shows Shift Starting

December is always a large options expiration as we have large open interest and a SPY dividend payment. Because of all of this the expiration has the potential to mark turning points in the market as large positions are closed, roll or expire. 3200 has been a key level the last week with major options […]

Why Dec ’19’s Large Open Interest Could Cause Volatility

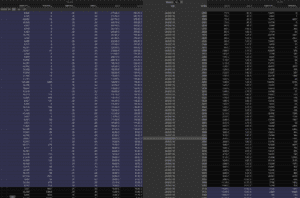

December OPEX has a many strikes that have large open interest (OI). For calls there are many in the money strikes as you can see in the grid below with OI greater than 20k or 40k – the 3000k strike has 125k contracts. There is large size in puts as well, but these are currently […]