The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, Key Delta Strike, and other metrics for each stock and compare the values with the previous […]

Market Analysis

Watch: June OPEX Same Size as March 2020?

Brent, Founder of SpotGamma, discusses how the large June ’22 options expiration is in similar size to that of March ’20. Based on this, we think the market may stage a brief rally. Start a FREE 7 day trial of SpotGamma now to get daily insights just like this.

Brent on The Market Huddle: Positional Analysis Into a Major Expiration Event

Brent, Founder of SpotGamma, joined The Market Huddle podcast to discuss the upcoming large options VIX & equity expirations (June 15th & 17th). Adding to the energy of large options positions rolling off is the June 15th FOMC. Listen to the podcast here, and download the slide deck here. We will be providing daily updates […]

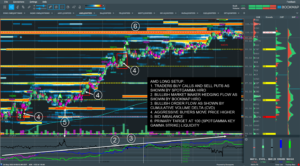

Trade Analysis: AMD (May 26, 2022)

The following is a guest post from Doug Pless. When I plan to trade stocks for the day, I begin my morning preparation by opening my watchlist in Equity Hub. I look at the Key Gamma Strike, Hedge Wall, and other metrics and compare the values with the previous values for the last five days. […]

GME Pinning Options Levels After a Huge Rally

On Friday Brent was joined by Saad from ShiftSearch to analyze the >20% rally in GME last week. They discussed why GME was ripe for a pullback, and why $120 was the big level of support for today, Tuesday May 31st. Below you can see how that $120 level has acted as major support today. […]

Excess Returns Interview: What Equity Investors Need to Know About Options Impact

Brent Kochuba, Founder of SpotGamma, speaks with Excess Returns about signals equity investors can pull from the options market.

Brent On TastyTrade Live 5/19/22

Brent, Founder of SpotGamma, joins Victor and Chris from TastyTrade to talk about how hedging flows around OPEX may drive a short term rally in markets.

On the Wrong Side of Convexity

SpotGamma Founder, Brent Kochuba, discusses his trading experience during the August 2015 market crash when the market went limit down. Brent saw first hand why you need to be careful being short convexity, and how margin rates are subject to rapid change.

Will The Fed Push Stocks Over The Edge Next Week?

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Hard Landing Worries Are Driving Volatility Volatility in the market has been high as traders and investors look to hedge risks associated with the Fed and the potential for an economic slowdown. The concerns seemed to evolve, starting with inflation and growth worries. Now […]

SpotGamma Discusses Using Options Levels for Futures Trading | Live with NinjaTrader

Presented by the NinjaTrader Ecosystem, Trader’s Workshop is dedicated to serving and developing real futures traders. Brent Kochuba discusses the impact that the options market has on futures trading and why paying attention to options should be in every future’s trader’s toolkit.