Our proprietary “Combo Strikes” which blend SPX and SPY interest have been great support/resistance lines for trading SPY, ES or SPX. You can see in our AM note highlighted below we marked 3136 (SPX) which is 3126 (ES) as a resistance level. Below is the quoted range from our AM premarket subscriber report. That level […]

Market Analysis

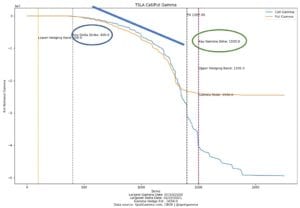

TSLA Convert Bonds Options & Gamma Traps

We think that much of what has pushed TSLA’s massive runup in price has been a “gamma trap“. The idea being that in-the-money long calls and new long call positions force dealers to buy the stock as it goes higher. Our model detects a lot of very deep in the money <=400 strike calls, which […]

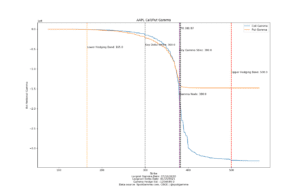

FAANG Options Expiration Gamma Pin

Our equity analysis models are in BETA but as we watch the data come in we pick up on a few interesting things. One of those was today when 4 our of the 5 FAANG (AAPL, AMZN, NFLX, GOOGL) names have their highest “gamma expiration” today: 7/10/20. Whats also interesting is that at the time […]

SPX Same Day OPEX

We ran a detailed analysis of the impact of same day options expiration volume vs open interest and the effect this may have on “pinning” the market into the close. Some may also refer to the idea as “options max pain”. You can read it here but we thought it was worth showing the effect […]

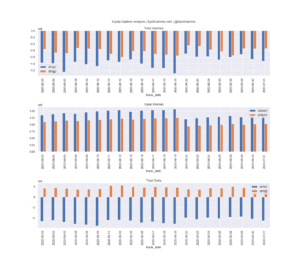

Equity Options Gamma Shows Stretch

Our equity options gamma indicators are showing that negative gamma rates in single stocks are growing back to where record levels were a few weeks ago. Back then there was news of “record small trader” positions in call options. You can see there is a similar position below. In the charts below for TSLA, AMZN, […]

SPX Option Delta Tilt™ as an Indicator

We have been studying SPX options deltas and changes in those deltas for some time. Finding a definitive indicator in this data has been a challenge, but there certainly appears to be something here. For this reason we are posting this current chart of our Delta Tilt™ indicator. Notice that large moves down in the […]

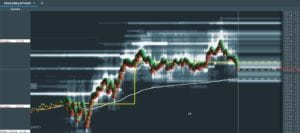

SpotGamma Levels at Work

We publish key levels based off of S&P500 options gamma and interest levels before the open. We can push these levels into various trading systems like Bookmap. As you can see in the Bookmap screenshot below the ES futures played off of our trading levels throughout the day. The market opened and immediately tested 3025 […]

SpotGamma Report for: 06/23/2020 PM

### You must be logged in to access this content. Don’t have an account with SpotGamma? Sign up today to view unique key levels, Founder’s Notes, market commentary, options analysis tools, and expert insights. If you’re already a SpotGamma subscriber, log in here: Username or E-mail Password Remember Me Forgot Password

Opex Quadwitching Rebalance Market Shenanigans

We are posting this as a reminder to all those that want to play in the market during large OPEX days also known as Quad Witching. Below is snapshot from the CBOE official settlement page. It shows an opening price of 3161 which is where all of the SPX AM options would officially be marked. […]

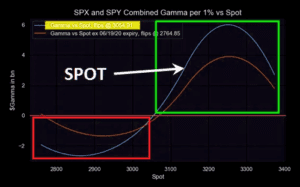

SPX Options Expiration vs Equities

We spend a lot of time talking to our members about the lack of structure in the SPX options market. What we mean is the positioning in SPX options is just very small as seen in this chart below which maps total SPX call & put gamma. This has implications for markets not just at […]