There have been lots of short gamma charts lately but today’s action looked like a long gamma kick save. News about Iranian enrichment pushed the market down at ~11EST and there was a decent drop to ~291 – a dip that was bought. The previous close was 292.5 and we model that because of the […]

Market Analysis

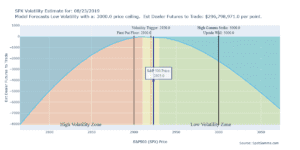

SPY Gamma Market Outlook

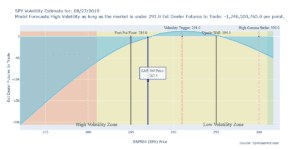

TradingView SPY Chart With Gamma Range Based on our options gamma model we see 285 in SPY as a decent support level due to size of put open interest. At the top of the range sits the volatility trigger level aka “zero gamma”. Options dealers will be buyers up to that level, but transition to […]

Nomura’s Latest Gamma Call 8/27/19

Don’t consider this grandstanding, but it highlights an issue with people bent on constructing a narrative around models. Recently a Nomura analyst put out some great research but seemed to be bent on making it bullish, when the data clearly says neutral. Nomuras latest gamma call shows output similar to our model in that Gamma […]

The Options Gamma Trap

Much has been made recently of the ominous “options gamma trap” and its potential effects in stock markets. What is an Options Gamma Trap? An options gamma trap is when options dealers are positioned “short gamma” and cause large swings in the stock market. To hedge a short gamma position you sell stock when the […]

Pre Open Gamma Snapshot 8/26/19

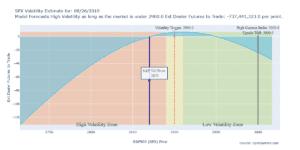

SpotGamma Model Outlook for today using a futures reference price of 2870. Dealers are short a healthy amount of gamma meaning they are going to fuel the market move at open. A short gamma position means a higher market means dealers will start buying and if the market drops at open they will sell along […]

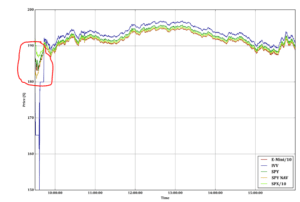

Notes From 8/24/2015 Crash

Monday August 24th 2015 was a memorable day and it seemed like a good idea for a quick review given how much the current market seems to be trading. This is not a prediction for a market crash. There were a litany of reasons credited with causing the crash ( go here to see). Markets […]

8/23/19 Stock Market Crash: Review of Friday Chaos

Quick review of days events through the SpotGamma model lens. Most of the notes from the 8/26/19 stock market crash are included in the graphic below. Essentially our model viewed this event as follows: Trumps Tweet about China caused a quick market drop that was compounded by dealers who were short gamma. This caused them […]

“ALGOS” will Destroy the World! Gamma Traps and Liquidity

Good article here about active/passive investing and the thread of robots breaking the market. There is a good description of “gamma traps” and liquidity around options gamma. Two interesting pieces: When gamma is positive, options quickly get more valuable when the price of the related shares rise. The bank taking the opposite position to the […]

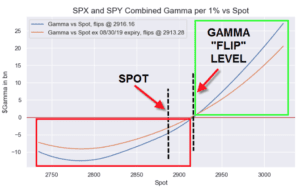

FED, TRUMP, Gamma Trap: Crazy Trading Day 8/23/19

Fed gave a speech that was “volatility dampening” at 10AM. Trump didn’t like what the Fed had to say so he started tweet-trashing the Fed and China triggering a “gamma trap“. Stock markets were just at the volatility trigger level of 2920 (black horizontal line) so the gap down flipped the trigger and dealers were […]

Review of Flash Crash of May 6, 2010

Some liquidity notes from SEC review of the “Flash Crash” of 6/10/2010. Day started off with video of riots in Athens. Market was down a few percent and VIX was up. Liquidity started to thin out (from what was already low levels), then a massive futures order came in ($4bn notional). The order was one […]