You’ve asked for it – and we’ve delivered! This has been one of the most requested integrations by our respective communities: SpotGamma’s key trading levels are now live within the TrendSpider platform. What is TrendSpider? TrendSpider is a powerful charting software designed by traders for traders. It offers a comprehensive and modern trading solutions that […]

Market Analysis

Case Study: A Step-by-Step Bearish Trade Breakdown of Nvidia (NVDA)

Author: Doug PlessProfessional Trader & SpotGamma Content Contributor Case Study: A Step-by-Step Nvidia Bear Trade Breakdown In this case study, full-time Professional Trader and SpotGamma Content Contributor Doug Pless demonstrates how he uses SpotGamma tools to plan and execute a trade in Nvidia stock. The process involves positional analysis, focusing on market makers’ positions and […]

Stock & Bond Correlations: “No Crying in Correlation”

Alpha Exchange

S&P 500, Correlation & Low Volatility: The Big Trade Underneath the Strangely Calm Surface of the S&P 500 | Odd Lots

In the latest episode of Odd Lots, Tracy Alloway and Joe Weisenthal explore current market conditions, emphasizing the interplay between dispersion, correlation, and volatility. The episode, recorded on June 13, highlights how the S&P 500 has consistently shown upward momentum, albeit with minimal daily gains. The discussion introduces the concept of the dispersion trade, which […]

OPEX Effect: June is Call-Bloated

In The OPEX Effect: June 2024, Brent Kochua and Jack Forehand discuss the impact of options expiration (OPEX) on market volatility and specific stocks, such as Nvidia. During periods of low market volatility, significant call positions expiring can lead to increased market movement and volatility. They mention the influence of JP Morgan’s collar positions on the […]

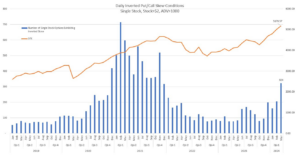

The Downside of Call Selling Funds

Last week, our founder Brent Kochuba attended the EQ Derivatives conference in Las Vegas. The conference attracted attendees from various backgrounds, including pension funds, sell-side firms, exchanges, and fund providers. One of the hottest topics over the two days of presentations was the proliferation of systematic call overwriting. The interest in this discussion was driven […]

GME Options Implode – The Tax of IV Decline

$GME vol has totally faded, just like the interest in @TheRoaringKitty twitter feed (sooo many video clips – that can’t be him posting). Anyway, here we see the peak in 1-month IV at +340% on Tuesday (yellow) when the stock hit >$60. Stock up, vol up. Now the IV’s (and GME’s stock price) have come […]

Unpacking May OPEX: How Will Low Volatility and NVDA Earnings Shape The S&P 500?

Key Points: A Brief Synopsis: Large call positions are driving low volatility into May options expiration. The expiration of call positions lines up with several key data points (Fed Speaking, CPI) which may cause volatility to briefly expand into the end of this week (Friday, 5/17), and into VIX expiration & NVDA earnings on 5/22. […]

Is the Unprecedented Market Calm Driven by 0DTE and Overwriting ETF’s?

In the presentation and outline posted below, SpotGamma presents a view that equity markets are experiencing dramatically low levels of volatility. The generally low levels of volatility are likely in response to both monetary & fiscal policy, globally, as low volatility is seen across many assets and regions. However, we believe that the impact of […]

Trade Analysis: META Flashback (April 4, 2024)

Author: Doug PlessProfessional Trader & SpotGamma Content Contributor Case Study: A Winning Trade in Meta (META) with Doug Pless In this detailed case study, Doug Pless demonstrates how to leverage SpotGamma’s powerful tools to plan and execute a successful trade in Meta (META) on April 4, 2024. Utilizing SpotGamma’s Key Daily Levels, HIRO, and Equity […]