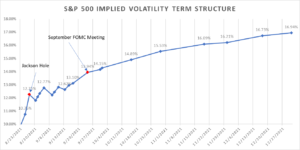

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Jay Powell will speak at next week’s Jackson Hole Economic Symposium. Some investors think it may be where he lays out the Fed’s path towards the tapering of asset purchases. Recent economic data suggests that inflation is running at levels that […]

expiration

SpotGamma 1/18/21

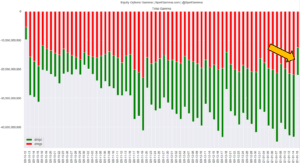

We noted to subscribers on Thursday & Friday that we thought markets were entering a period with the potential for high volatility. This was due to Friday’s very large 1/15 options expiration which resulted in a ~50% reduction in single stock gamma as seen below. This creates volatility because as large options positions expired, are […]

TSLA into the S&P500

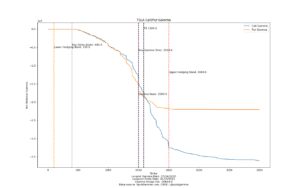

In TSLA the largest gamma area was $600 heading into today. The stock traded down to $605 earlier this AM, $620 now. The largest volume & OI region is >=$650 44% of TSLA gamma exp on close of12/18, by which time ~$50bn of TSLA stock needs to be bought by S&P indexers

Nomura August “Extreme Gamma”

From ZH As the Nasdaq goes from new record to new record high day after day, passively lifting AAPL to become the world’s first $2 trillion market capitalization company, something uncomfortable is happening under the hood. While the concentration of gainers in the Nasdaq has been well-discussed… There is an increasingly ominous major (bearish) divergence […]

Silver August Expiration

Below is our most recent data for SLV (silver ETF) going into Fridays August options expiration. Call option positions remain at or near the highs we’ve seen over the last several weeks. There is a large concentration of options at the 25 and 30 strikes which presents an interesting setup. If SLV can charge ahead […]

S&P 500 Double Top

Its interesting too look back at where we were in February ’20 just days before the crash. Clearly things are different now, and we are suggesting a >30% drawdown (for one, the put fuel isn’t there). However its interesting to compare sentiment and data particularly as we have hit a double top just before a […]

TSLA Options Pre Earnings

TSLA reports earnings tonight, and there is a ton of options gamma to generate a large move tomorrow. We define key levels for the stock as follows: Lots of Gamma at 1500 – thats the “pivot” area where stock remains a bull above, bear below. There are a ton of in the money calls at […]

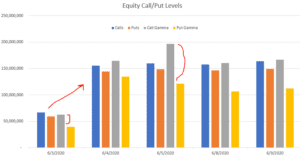

Equity Call Euphoria & OPEX Concentration

We have been reviewing the last 5 days of options data in light of reports showing record levels of call positions. Seen below you can see that call volumes have exceeded those of February 2020 – something we felt helped lead to the large drop in March. As you can see below our data suggests […]

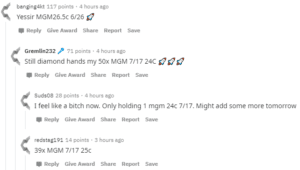

The MGM Call Spectacular

Intrigued by the record amount of call buying we decided to take a look at options in one of the more speculative names: MGM. There wasnt much of a scientific process to select a name, we just jumped to Reddit /wallstreetbets and chose the first name they were excited about. It seems like these folks […]