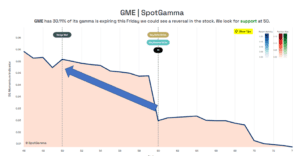

On 2/1 with GME stock at $225 we wrote about how options dealer flows could result in the stock dropping to the $60 strike. We highlighted this strike because it was where the largest concentration of options were placed (from a gamma perspective). You can see that is is precisely what has played out: This […]

gamma trap

Weaponized Gamma Reloaded

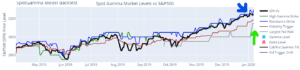

The latest options data revealed that equity option call buying surged this week, blowing out the previous record week. Shown in the chart below is the total number of contracts bought to open netted against contracts sold to close. This suggests that traders on net did not elect to close out of their long calls […]

When YOLO goes “YOL-Oh No!”

Summary: Issue: SpotGamma believes that current markets reflect a great amount of risk and face the prospect of a violent drawdown. This is due to the following: Hedging: Low levels of options-based hedging. Short-Selling: Low levels of stock shorting. Speculation: High levels of margin used to buy stocks. Remedies: SpotGamma levels continue to be […]

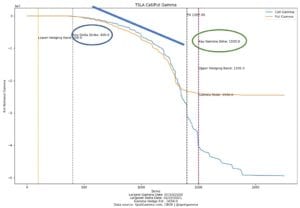

TSLA Convert Bonds Options & Gamma Traps

We think that much of what has pushed TSLA’s massive runup in price has been a “gamma trap“. The idea being that in-the-money long calls and new long call positions force dealers to buy the stock as it goes higher. Our model detects a lot of very deep in the money <=400 strike calls, which […]

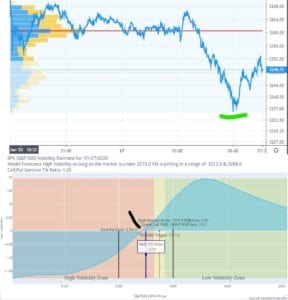

SpotGamma Report for: 03/13/2020 AM

### You must be logged in to access this content. Don’t have an account with SpotGamma? Sign up today to view unique key levels, Founder’s Notes, market commentary, options analysis tools, and expert insights. If you’re already a SpotGamma subscriber, log in here: Username or E-mail Password Remember Me Forgot Password

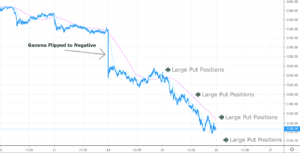

Poor Liquidity & Negative Gamma: Volatile Stuff

We’ve written extensively about negative gamma and poor liquidity during volatile markets, and wanted to post some of those effects in real time. ZH posted an article framing how bad liquidity in ES futures is, note the chart below: as the following chart from Deutsche Bank shows, overall liquidity for S&P500 futures has fallen to all […]

February 2020 Selloff & Gamma Trap

There has been relentless selling during the end of February attributed to Coronavirus fears. There are clearly sellers of all types active in the current market, but much of this selling may be attributed to negative market gamma and the “gamma trap”. As you can see below on over the weekend of Feb 24th futures […]

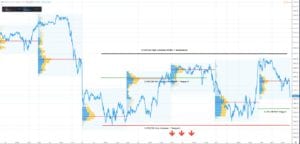

Somethings Gotta Give – The SPX Box

A quick note, particularly for documentation. Currently (1/31/20) the market awaits a slew of catalysts including: coronavirus updates, Iowa caucuses and the Chinese market reopening. For the last few days we’ve been contained in this fairly volatile range between ~3300 (our high gamma strike) and ~3240 (zero gamma). Above we can bask in the comfort […]

Zero Gamma Holds Again – Virus Edition

A combination of new regarding the Chinese virus spreading and Iraq being bombed sent futures lower on Monday AM. Oddly the low of the overnight session was 3237, which we calculated to be the zero gamma threshold. Remarkably the same thing occurred a few weeks ago on the eve of the Iranian bombing. Should the […]

Possible Gamma Flip Setup 1/7/2020

We’ve been tracking very high levels of call gamma the last several weeks that has recently stalled as we’ve hit heavy resistance around 3250 (blue arrow in chart below). During the last several days the zero gamma flip point has moved higher to ~3185 as you can see (green arrow): Iran has started launching missiles, […]