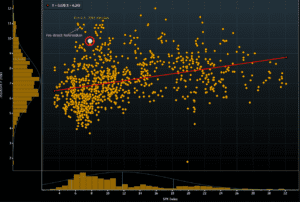

As per Bloomberg, Skew (which measures the price of calls vs puts) can often spike when investors are concerned about market risk. Puts will be in higher demand than calls and this moves the skew measurement higher. Currently skew is very high due to a slew of events in the next week: FOMC, BREXIT vote, […]

gamma trap

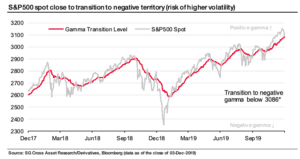

SocGen Zero Gamma Chart History

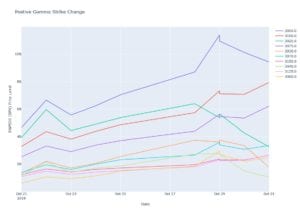

Here is a backtest of where SocGen calculates where positive gamma changes to negative gamma in the S&P500 (SPY). You can view our historical chart here. The concern is that a move through the zero gamma level may set a “gamma trap“. Our FAQ has more information: Zero Gamma Level: This is the estimated level […]

The January 2018 Market Analogy

We’ve been seeing extreme call/put measures the past several weeks and these extreme measures only give way to more extreme measures. Nomura & JPM noted how heavy call positioning is relative to puts recently. There is also anecdotal evidence like this chart below, where Macrohedged notes: ” We cannot recall EVER seeing max OI for […]

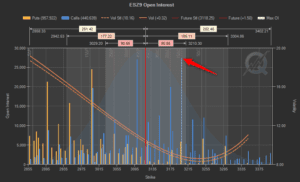

Monitoring the Call Gamma Squeeze

The idea has been that the roll-up of the 3050 calls to 3100 calls has caused a squeeze (see here) and that the 3100 strike currently holds the key to the next move in the SPX. November SPX expiration may help to get things moving – you can see in the chart below there is […]

Call Roll Gamma Trap

Most of the time when we talk about “gamma traps” people assume its a downside only event. I don’t think thats true. As I once read somewhere “gamma happens both ways”. There is evidence the last several days rise in stocks was caused by calls being rolled up. If market makers are on the other […]

The “Impeachment” Gamma Trap

Going to Tuesday we noted 2970 as the 0 gamma volatility trigger and on Wednesday we pushed below that volatility trigger level indicating we should see some large moves in the SPX. The chart of the past two days in ES futures is here: Here was our gamma run from 9/24: After the close on […]

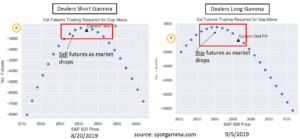

Short Gamma vs Long Gamma

As dealers were short gamma for most of August they have moved to long gamma. Below is a chart comparing their theoretical behavior in each gamma regime. You can see when dealers are short gamma and the market is falling they are trading with the market, fueling the drop. Conversely when long gamma they are […]

The Options Gamma Trap

Much has been made recently of the ominous “options gamma trap” and its potential effects in stock markets. What is an Options Gamma Trap? An options gamma trap is when options dealers are positioned “short gamma” and cause large swings in the stock market. To hedge a short gamma position you sell stock when the […]

“ALGOS” will Destroy the World! Gamma Traps and Liquidity

Good article here about active/passive investing and the thread of robots breaking the market. There is a good description of “gamma traps” and liquidity around options gamma. Two interesting pieces: When gamma is positive, options quickly get more valuable when the price of the related shares rise. The bank taking the opposite position to the […]

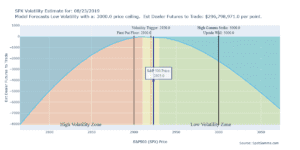

FED, TRUMP, Gamma Trap: Crazy Trading Day 8/23/19

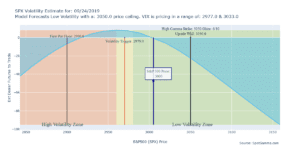

Fed gave a speech that was “volatility dampening” at 10AM. Trump didn’t like what the Fed had to say so he started tweet-trashing the Fed and China triggering a “gamma trap“. Stock markets were just at the volatility trigger level of 2920 (black horizontal line) so the gap down flipped the trigger and dealers were […]