Here is a very low level primer as to what dealer gamma means and why those levels appear to influence the markets. There are many assumptions and oversimplifications made here. See our other articles and FAQ for more detailed information. Dealer gamma is a dollar value that estimates how much options dealer may have to […]

gamma

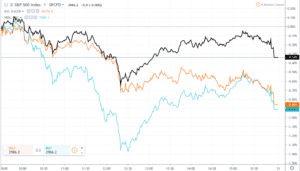

Gamma Effect Seen In Index Movement

Lets classify this as what it is: speculation (at best) but its quite interesting on days like yesterday when the S&P is down only 34bps while Nasdaq and DOW were down ~90bps. Yes, Boeing (BA) hurt the DOW in particular but that wouldn’t explain the Nasdaq performance. The theory that should be bookmarked here is […]

How an Option Pin Plays Out

The current October options expiration portrays how an options pin can play out. For several days we have seen 3000 as our high gamma strike, with options volume at 3000 strike dominating the market. As the market moves away from this strike options dealers and other options hedgers move the price “back in line” to […]

Mid October Rally

Here is a chart mapping out how we viewed this recent rally back up to 3000 in SPX, along with a bit of a prediction. The volatility crush sparked a rally today up to our “high gamma strike” of 3000. Because gamma is very high (~$1bn per S&P500 point) and 3000 is a high gamma […]

Nomuras Gamma View after the Rally

Via Heisenberg, here is Nomuras Gamma View after the Rally. They note the following: “[The SPX was ]gravitationally pulled higher (spot 2970) and now sits comfortably between the two large $Gamma upside strikes of 3000 ($3.7B) and 2950 ($2.5B)”…“As the bullish macro catalysts have indeed begun materializing, the various hedge expressions (VIX upside, S&P downside, […]

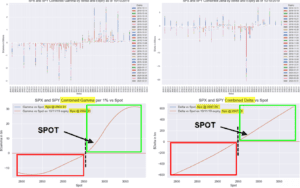

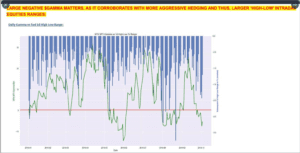

SPX Distribution vs Gamma Levels

from Heisenberg: you can see when gamma is large and positive the market moves much less than when gamma is large and negative.

Saudi Oil Attack Options Gamma

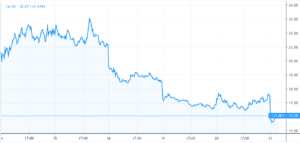

Here is a quick snapshot after the Saudi Oil attack – options gamma is still quite long with over $1bn long gamma per point in the S&P500. This may have had an effect on muting or “deleveraging” the reaction to the news about the Saudi Oil attack. There was a very large move in crude […]

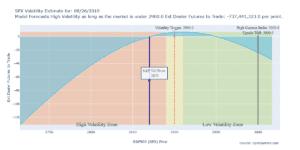

Pre Open Gamma Snapshot 8/26/19

SpotGamma Model Outlook for today using a futures reference price of 2870. Dealers are short a healthy amount of gamma meaning they are going to fuel the market move at open. A short gamma position means a higher market means dealers will start buying and if the market drops at open they will sell along […]

Gamma Driven VIX Drop

There was quite a large move down in the VIX overnight (8/20/19) and Nomura claims that was due in part to the gamma around a large VIX position. This gamma driven VIX drop is apparently related to hedging around a large VIX position. When options decay this can effect the amount of hedging that a […]

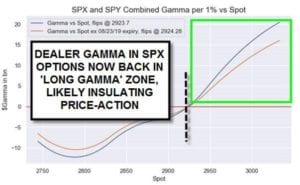

Nomuras Analyst Jumping the Gamma Gun

Nomura published an updated gamma chart showing that options dealers are now “Long Gamma…likely insulating price-action”. Nomuras options gamma estimate of 0 at 2923 is essentially the same level as our “Volatility Trigger” which is 2920. The issue with their analysis is that appears to be jumping the gun. Zero and positive are not the […]