The VVIX measures the expected volatility of the VIX itself — giving options traders a window into hedging demand, dealer positioning, and what the market is pricing before volatility materializes. SpotGamma’s forward return data shows

what elevated VVIX levels have historically meant for SPY and VIX.

VIX

Flat Index Masks Hidden Chaos

Overall price stability in the S&P 500 is masking one of the most unusual equity environments in recent years. While SPX has been roughly flat over the past month, the average constituent has moved 10.8% — a 99th percentile dispersion reading, as we discussed in our Thursday AM Founder’s Note. All signs point to increasing fragmentation beneath […]

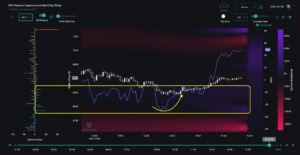

The Market’s 0DTE Underbelly Is Exposed

Last week reminded us just how fast market stability can give way to volatility. After trading near all-time highs at 7,000, the S&P 500 fell 3% in just three sessions, closing Thursday at 6,798 amid weakness in software and crypto. Our last Sunday Newsletter focused specifically on how this type of fragility underscores today’s market. This […]

SPX Touches 7,000 and Cracks — What Makes This Market So Fragile?

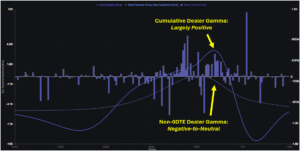

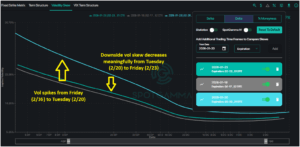

Market Fragility in the Face of All-Time Highs As the S&P 500 pushes record highs, the options market continues to flash warning signals beneath the surface. Underlying risk from volatility discrepancies and index-equity correlation suggest an environment prone to vol spasms — similar to what we witnessed with Thursday’s (1/29) sharp selloff and reversal. These […]

Vanna Fuels Market Rally as Market Fears Subside

Last week began with fear dominating market sentiment: analysts widely attributed Tuesday’s 2% SPX selloff to Greenland worries and tariff threats. As we pointed out in last weekend’s newsletter, traders had begun hedging against downside risk as put skew increased and volatility premiums rose. However, the quick turnaround back to SPX 6,900 seemed to erase any […]

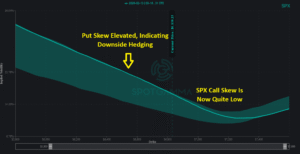

Defensive Positioning Emerges as Market Rallies

Traders Turn Defensive In the Face of Market’s Climb SPX tested fresh all-time highs last week, with positive gamma providing guardrails for the broader market. In the face of headline noise—from criminal investigations into Powell to Iran-related escalation—the market absorbed every dip, with the 6,890 Risk Pivot level from Monday’s AM Founder’s Note holding firm. However, increasing put skew and […]

SpotGamma on Stock Market TV

SpotGamma joined Stock Market TV to discuss how options drive stocks, including what signals are provided by Call Walls & Put Walls. We also dove into why the VIX can often be a misleading volatility signal. Find High-Reward Setups — FastStart Profiting

Why is the VIX So Low? Structured Products Offer an Answer

Equity market volatility (VIX) has been surprisingly low in 2023 despite uncertainty about interest rates and geopolitics. Some attribute this to the rise of short-term “zero-days-to-expiry” (0DTE) options trading. However, a recent article by the BIS argues that 0DTE trading is unlikely to be the main cause for low VIX and provides an alternative explanation: […]

The Silicon Valley Bank Collapse and How the Options Market Reacted

The VIX Jumps, Shocking Record Put Volumes and Real Tail Risk With the SVB risks, we see a shift higher in options tail risk pricing, but not a surge in open interest at a macro level. KRE, the Regional Bank ETF, saw record put volume, and there is record VIX call open interest. XLF and […]

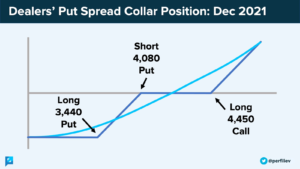

‘Call AAA’: Santa Claus Is Having Sleigh Troubles

Through an options market lens, the following text will add color to some recent market movements.