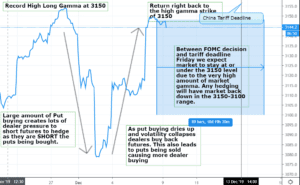

Here is a chart outlining how we saw the selloff during the first week of December 2019. There was record high gamma going into the first week of December which indicates that call:put ratios were at extremes. After a few negative tweets about trade and a poor ISM number selling started, and put buyers stepped […]

gamma

Nomura’s Gamma December Note

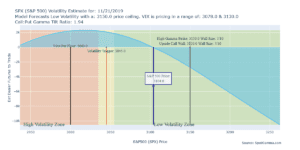

Our model has gamma flipping at 3065, Nomuras is a bit higher. From ZeroHedge The interpretation of Trump’s “better to wait until after the election” for a China trade deal comments is that the Hong Kong human rights bill sponsorship by POTUS has clearly caused agitated the Chinese side (plus this morning’s Reuters report stating […]

SpotGamma vs Nomura

We like to post the banks gamma model output as way to check our own models. The two line up almost exactly. For now, US equities are “pinned” thanks to helpful greeks – at least until something really bad happens. “The fact remains that SPX will stay ‘sticky’ up here between the enormous 3100- ($9.4B […]

Action on “China Phase 1 2020” Selloff

Here is our view of the trading day today. The market started off the day long abut $2bn in gamma and at the lows of the day it was down to ~$1.75 bn. Despite the reduction that is still a hefty amount of gamma that supports a mean reverting market. On top of that we […]

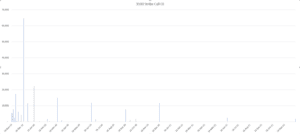

Gamma vs Realized Volatility

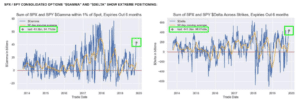

Gamma appears to give traders an edge in predicting market volatility. Here we show the last few months of historical volatility as a quick method to back up this point. Volatility does not imply a direction in the market, just expanded movement. Often this is correlated with market drops, but also rapid rises as seen […]

Nomuras November Gamma Report

From Heisneberg we get a glimpse into Nomuras gamma view, which seems to coincide with what we see. Namely gamma is about as high as we’ve ever seen, this past week hitting $2.7 billion compared to an all time high of ~$2.9bn in August of 2018. At the same time, investors have leaned into equities […]

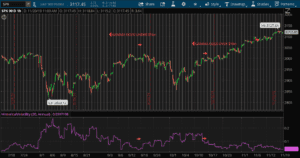

Gamma Does Exist! Pin Edition

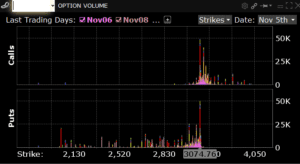

3075 dominated volume and $SPX closes 3074.77. Gamma forecast was range of ~15 handles on day. Here is an explainer on market gamma for those new to the concept.

Monitoring the Call Gamma Squeeze

The idea has been that the roll-up of the 3050 calls to 3100 calls has caused a squeeze (see here) and that the 3100 strike currently holds the key to the next move in the SPX. November SPX expiration may help to get things moving – you can see in the chart below there is […]

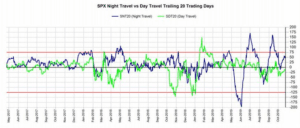

Does Gamma Create Overnight Market Out-performance?

One of the working theories we’ve had is that the out performance of the S&P500 during the overnight session is due to market gamma. The idea is that options dealers gamma hedging keeps the market in check during cash sessions, and overnight the market can move about more. The chart below shows how much more […]

Why Market Gamma May Be Useful for Futures Traders

Here is a quick example to illustrate how market gamma may be useful for a futures trader. The last week SpotGamma has calculated a very large amount of gamma in the market, north of $1 billion. That predicts a tight, range-bound market. Below is a chart of the last month, the yellow box highlights a […]