No, I’m sure they arent. But there are a lot of overlap. From our recent subscriber notes: 2950 should now set up as the High Gamma strike resistance with 2900 the first line of support. As we are in positive gamma territory we see decreased risk of a sharp sustained drop from this level – […]

nomura

Pre Fed Dealer Gamma Charts

We note to subscribers today that the market is at a key “gamma crossroads” around 2900 where we see sustained positive gamma above that level and the possibility of a strong move into negative gamma if the Fed disappoints today. For the past week we have been consolidating around the zero gamma level and options […]

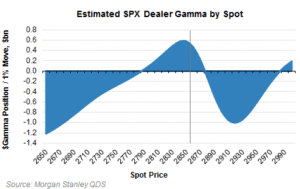

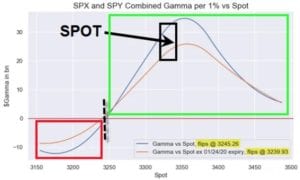

Nomura’s Gamma Estimate April 2020

Zerohedge gives us Nomuras gamma estimate for 4/24/20 with an estimate gamma flip point of around 2800 in the SPX. Note this is a COMBINED SPY/SPX estimate. As Nomura’s Charlie McElligott notes, the S&P 2,800 has emerged as the “Neutral Gamma” zone for the market “and again, is likely to remain that way, as the […]

Nomuras Pre-OPEX Market View

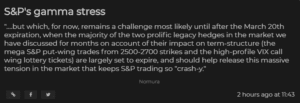

We wrote a few days ago about the importance of tomorrows 3/20 options expiration because of 1) its sheer size and 2) its amount of deep in the money puts. ZeroHedge adds to this sentiment with some notes from Nomuras McElligott: this “large decline in the gamma post-expiration” should allow markets to pivot back to […]

When Might this Volatility End?

We have been targeting next weeks OPEX 3/20 as a key time in this “volatility cycle” as there is very large open interest. As that open interest is closed or rolled it may allow some calm as call options are re-struck closer to at-the-money and put options are rolled out and down. This could effectively […]

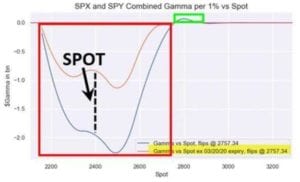

March ’20 Nomura Gamma

Great post from Heisenberg about Nomura and SocGen Gamma reports below. This chart went up on Thursday 3/5 – here is the SpotGamma gamma chart for reference: In “We’re All Momentum Traders Now”, I spent quite a bit of time attempting to drive home one overarching point: Directional moves over the past two weeks have […]

Nomuras View of Feb 2020 Crash

My view of the past week has been this: The markets slipped into negative gamma on Monday 2/24 under the narrative of Coronavirus fears. As large concentrations of puts went in the money their hedging requirements increased, meaning gamma got more negative as the market moved lower. Once in negative gamma territory options dealers change […]

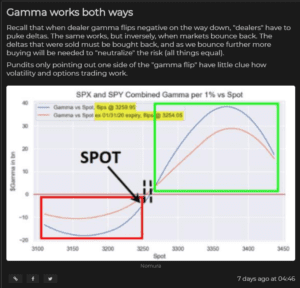

Yes, Gamma Works Both Ways

There has been quite a rally of of recent lows as the market has been digesting Coronavirus headlines. A bit over one week ago the market was testing the “zero gamma” level – which can present a challenging choice for traders. The chart below shows ES futures with our levels noted from the first week […]

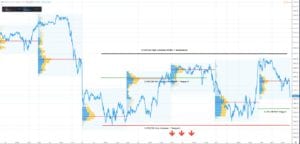

Somethings Gotta Give – The SPX Box

A quick note, particularly for documentation. Currently (1/31/20) the market awaits a slew of catalysts including: coronavirus updates, Iowa caucuses and the Chinese market reopening. For the last few days we’ve been contained in this fairly volatile range between ~3300 (our high gamma strike) and ~3240 (zero gamma). Above we can bask in the comfort […]

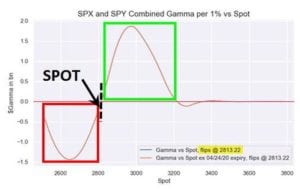

Nomura Gamma Update 1/22/20

Heisenberg posted an updated gamma note from Nomura, and we like to note them here versus SpotGamma data. Nomura posts a combined SPX/SPY figure whereas we break the data out. The note and charts sync with much of what we have been saying: That long gamma is still in control. Last week, Charlie noted that […]