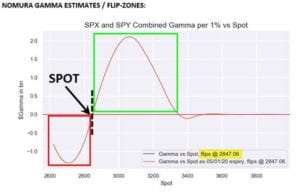

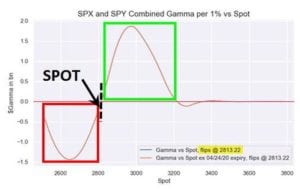

Like we wrote on Twitter and to subscribers a few days ago, the market is stuck in Gamma Neutral and Nomura agrees. Like our data, Nomura went from ~2940- ~2850. Exact flip points keep flopping. <2800 is trouble | >2900 we can all chase the top | 2800-2900 ¯\_(ツ)_/¯ pic.twitter.com/VvwkBETfms — spotgamma (@spotgamma) May 4, […]

Market Analysis

Nomura Draws the Market Gamma Line

We produced these levels in real time for subscribers, but if you’re a bit behind here is the update from Nomura via ZH. This note comes after the SPX tested 2950, and sold off toward the 2800 level on Friday 5/1/20. The gap also shocked the also just-established Dealer “Long Gamma” position (when ref was […]

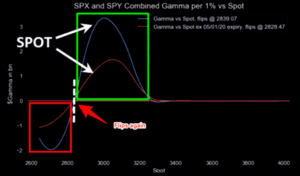

Nomura Gamma Update 5/1/20

From MarketEar: What about those CTAs and gamma dealers here? Yesterday people were quoting Nomura’s quant and his take on positioning: “…now increasingly outright ‘long gamma’…less spastic market moves” Per our post yesterday “Where is that long gamma today…” we pointed out; “Watch the downside should they “flip” to short gamma again….back to magnifying the […]

Is Nomura Reading SpotGamma Notes?

No, I’m sure they arent. But there are a lot of overlap. From our recent subscriber notes: 2950 should now set up as the High Gamma strike resistance with 2900 the first line of support. As we are in positive gamma territory we see decreased risk of a sharp sustained drop from this level – […]

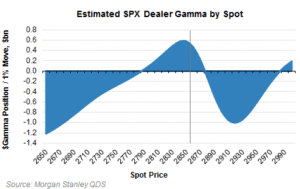

Pre Fed Dealer Gamma Charts

We note to subscribers today that the market is at a key “gamma crossroads” around 2900 where we see sustained positive gamma above that level and the possibility of a strong move into negative gamma if the Fed disappoints today. For the past week we have been consolidating around the zero gamma level and options […]

Options Gamma Levels and Futures Movement

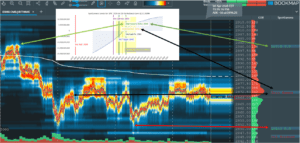

Today was an interesting day to highlight how our SPX Index options gamma levels can come into play for futures trading. Coming into today the market had experienced a sharp rally, and futures were set to open over 2900. Below you see a snapshot of ES futures in Bookmap, and our morning gamma chart (sent […]

Nomura’s Gamma Estimate April 2020

Zerohedge gives us Nomuras gamma estimate for 4/24/20 with an estimate gamma flip point of around 2800 in the SPX. Note this is a COMBINED SPY/SPX estimate. As Nomura’s Charlie McElligott notes, the S&P 2,800 has emerged as the “Neutral Gamma” zone for the market “and again, is likely to remain that way, as the […]

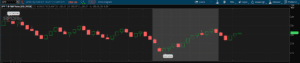

Example Gamma Level Trade in SPY

Today we want to provide an example of how we use the gamma data to setup a trade. Here we are using the SPX options data but using SPY to express our viewpoint that the SPX will stick to the 2800 area today. Note: This is a very basic trade and meant to convey general […]

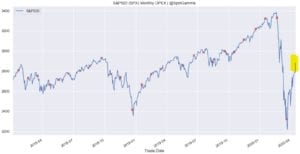

Can Options Expiration Turn 2/3?

We wrote about why we think SPX Options Expiration can create volatility before (see here) and wanted to post the chart below which shows just how impactful the large monthly SPX options expiration has been the last 2 months. You can see in the chart below the February expiration was within 2 days of the […]

The Options Magnet

We theorize that strikes with a high amount of options gamma combined with high options volume at that strike(s) can influence the SPX to that level. This something similar to an options “pin” but we think of it more as a “magnet”. You can see in the chart below that the 2800 strike has a […]