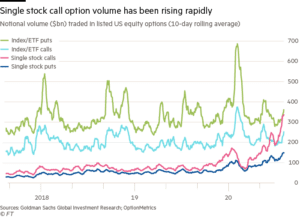

From the FT Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.comT&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article […]

nomura

Nomura August “Extreme Gamma”

From ZH As the Nasdaq goes from new record to new record high day after day, passively lifting AAPL to become the world’s first $2 trillion market capitalization company, something uncomfortable is happening under the hood. While the concentration of gainers in the Nasdaq has been well-discussed… There is an increasingly ominous major (bearish) divergence […]

Nomura August 2020 Gamma Update

Charlie McElligott’s prediction from last week that the Nasdaq could suffer from a nasty spill as dealer gamma had turned increasingly negative… … was foiled by the blockbuster earnings from the mega tech companies which sent the Nasdaq to new all time highs, forcing dealers – and frankly everybody else – to chase the year’s best performing […]

Nomura Gamma Update 7/23/20

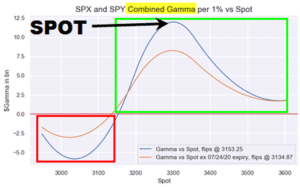

From ZH: Indeed, according to Nomura quant Charlie McElligott, after last month’s near-record Op-Ex, things are far more calm now and “3300 looks like the truth in Spooz, with nearly double the aggregate $Gamma ($4.5B) of the next closest line (3250 with $2.4B) as we head into expiry, thus exhibiting some “gravity” with Spooz up nearly 90 […]

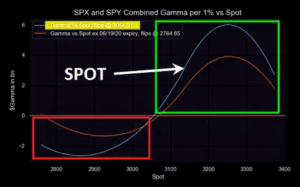

Nomura June OPEX Update

“Following Friday’s Serial/Quarterly options expiry, we continue to see potential for a ‘Gamma Unclenching’ over the following 1w-2w period with currently ~47% of the $Gamma set to run-off” – Nomura’s Charlie Nomura marks a much lower gamma flip point of June options expiration, which would suggest markets may open in more positive gamma territory after […]

Nomura 6/12/20 Gamma Update

Watch possible “gamma sweating” should this turn lower again Nomura’s quant explains the move yesterday; And here is why this this matters: as stated in the note to this point, yesterday was classic butterfly effect knock-on, with a “macro catalyst” from the COVID wave #2 risk-off trade which then triggered “profit-taking-turned-stop-loss selling” from both tactical […]

Nomura Pre May OPEX Update

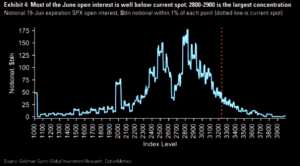

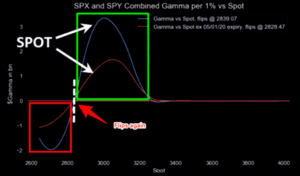

Like we have been highlighting to subscribers this weeks May SPX options expiration (OPEX) (Friday AM) could bring a state change to markets. From ZH we find another note from Nomura, echoing our sentiment: Into this week’s options expiry, Spooz (ref 2927) continue to remain pretty-sticky between 3 of the 4 largest $Gamma strikes on […]

Nomura Market Gamma Update 5/6/20

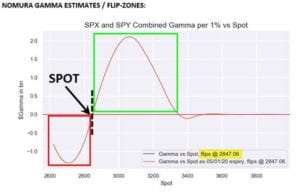

Like we wrote on Twitter and to subscribers a few days ago, the market is stuck in Gamma Neutral and Nomura agrees. Like our data, Nomura went from ~2940- ~2850. Exact flip points keep flopping. <2800 is trouble | >2900 we can all chase the top | 2800-2900 ¯\_(ツ)_/¯ pic.twitter.com/VvwkBETfms — spotgamma (@spotgamma) May 4, […]

Nomura Draws the Market Gamma Line

We produced these levels in real time for subscribers, but if you’re a bit behind here is the update from Nomura via ZH. This note comes after the SPX tested 2950, and sold off toward the 2800 level on Friday 5/1/20. The gap also shocked the also just-established Dealer “Long Gamma” position (when ref was […]

Nomura Gamma Update 5/1/20

From MarketEar: What about those CTAs and gamma dealers here? Yesterday people were quoting Nomura’s quant and his take on positioning: “…now increasingly outright ‘long gamma’…less spastic market moves” Per our post yesterday “Where is that long gamma today…” we pointed out; “Watch the downside should they “flip” to short gamma again….back to magnifying the […]