From ZH Last August, just before we learned that SoftBank was forcing a marketwide gamma squeeze in tech names, a little-followed quant at JPMorgan, Peng Cheng, came out with what may have been the most prophetic at the time market analysis, when he – unlike his “strategist” peers at major banks were trivially hiking their S&P year-end […]

Market Analysis

Groundhog Day

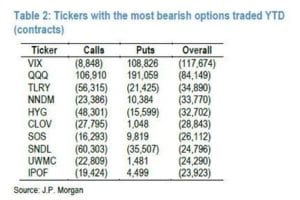

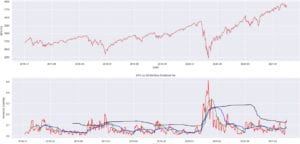

The current setup feels eerily familiar. In January of ’21 we wrote a note called “When YOLO goes YOL-OH NO!” which outlined the risks embedded in this market. At that time, we viewed market downside risk was high based on: Large speculative call positions which increased leverage and market volatility Small relative put positions which […]

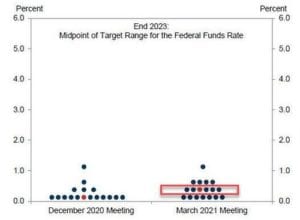

Pre FOMC Nomura Gamma Update

From ZH: With less than 24 hours to go until one of the most closely watch Fed announcements in a long time, the VIX finds itself hanging just below 20, the gamma gravity in the S&P is at 4,000 while dealers remains short Nasdaq/QQQ gamma (which however is shrinking by the day). In short, depending […]

SpotGamma on The Market Huddle

Brent (Founder of SG) was on The Market Huddle this week, starting at the 1:00:00 mark:

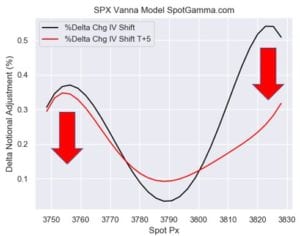

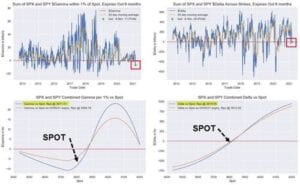

SPX SPY Options Vanna

Options Vanna is the delta adjustment required for a change in implied volatility. When we model market makers options hedging activity, we adjust options implied volatility to understand how hedging flows might impact the stock markets. Market makers likely hedge SPX and SPY options with ES futures, so these hedges may have a large influence […]

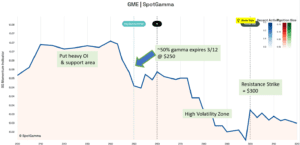

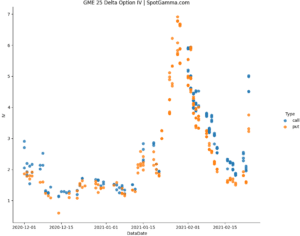

GME Gamma Squeeze Update

Yesterday we added a video which provided an update on our GME gamma squeeze model. We noted that some 50% of total GME gamma was set to expire at the close of trading on Friday, March 12th. The strike with the largest gamma position was the $250 strike, with most of that held in puts. […]

Nomura: “Max Short Gamma” Pain… But Relief Is Coming

Via ZH: Earlier this week we pointed out a bizarre divergence in the “greeks” – while the Nasdaq had slumped into negative gamma territory, which is where dealers are forced to sell more as the Nasdaq slides lower creating a feedback loop where selling begets selling, even as the S&P still remained in positive gamma […]

SpotGamma Report for: 03/04/2021 AM

Daily Note: Futures are holding 3800 after making a 3780 low overnight. Gamma is negative across all indicies indicating a large trading range is in store today. The largest gamma strike has shifted from 3900 to 3800, which is again highlighted as our critical support mark. We feel a push below that 3800 level likely […]

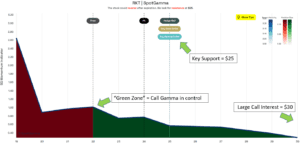

RKT Gamma Squeeze

We noted in a video last night that RKT was setup for a gamma squeeze, and the stock is up ~20% this morning. The stock has been rangebound for months and our proprietary indicators identified the setup for a gamma squeeze / stock breakout. As call positions increase, options market makers may need to purchase […]

GME Can’t Gamma Squeeze

As we outlined last week, GME can’t squeeze because the market makers are keeping implied volatility (i.e. the cost of options) very high. This reduces call buying, and therein reduces the leverage retail has.