The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Buy the Fed meeting. Sell the Fed minutes. It may be the name of the game for the stock market. At least since the start of 2022, the minutes have been a cause of concern for markets, while the FOMC meetings […]

hedging

June Selloff Review

Markets were unable to hold gains on Friday after a sharp selloff on Thursday. While we initially opened over the gamma flip zone, markets broke that 3075 area and immediately sold down to the 3000 strike. This 3000 level is where we calculated the most options gamma and served as support. All of these levels […]

Hedging Into the Close

@VolCurve brought up a great point today – ” Don’t mistake gamma hedging for strength.” It was an interesting example today of what looks like gamma hedging moving the market into the close. The market was quite weak today, but some force kept bringing us higher towards 3300 into the close. SPX options settle at […]

Options Market Gamma Theory is All About Volume

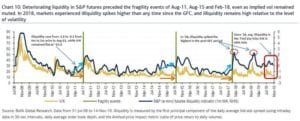

Options market gamma numbers proliferate the market but its important to understand what exactly those numbers mean. Yes, positive gamma may indicate lower stock volatility. And when gamma flips from positive to negative that may indicate higher volatility. But the actual gamma number itself is an estimate of how much stock dealers will have to […]

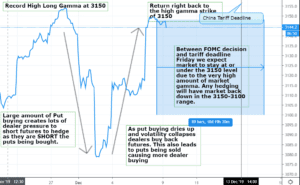

December 2019 Market Decline Review

Here is a chart outlining how we saw the selloff during the first week of December 2019. There was record high gamma going into the first week of December which indicates that call:put ratios were at extremes. After a few negative tweets about trade and a poor ISM number selling started, and put buyers stepped […]

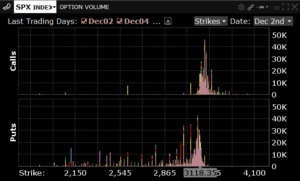

Strike of the Deltas – Can Put Deltas Move the Market Down?

Interesting day in the market today as numerous China related headlines took away a futures rally that was testing all time highs. Its our view that much of the selling today was due to put buying. It seems there was a decent amount of slightly OTM puts trading, combined with a large move up in […]

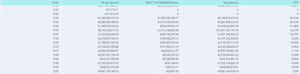

Tracking Deltas on a Large Expiration

Today is an interesting setup that we’d like to document. Currently its Wednesday afternoon with Thanksgiving tomorrow. Therefore tomorrow US markets are closed and a 1/2 day Friday. We picked up on our charts a large amount of at the money (ATM)/slightly in the money ITM calls expiring on Friday at the close. You can […]