Through an options market lens, the following text will add color to some recent market movements.

SPY

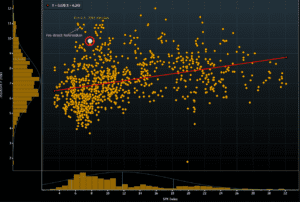

Trading ES Futures Using SpotGamma Levels and Vanna Model

The following is a guest post from Doug Pless. As I discussed previously, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Index, and Gamma Notional for SPX and SPY. The SpotGamma Gamma Index is a proprietary measurement […]

SPX Skew Nears All Time Highs

As per Bloomberg, Skew (which measures the price of calls vs puts) can often spike when investors are concerned about market risk. Puts will be in higher demand than calls and this moves the skew measurement higher. Currently skew is very high due to a slew of events in the next week: FOMC, BREXIT vote, […]

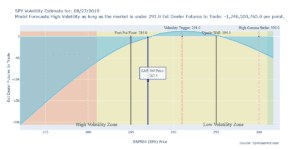

SPY Gamma Market Outlook

TradingView SPY Chart With Gamma Range Based on our options gamma model we see 285 in SPY as a decent support level due to size of put open interest. At the top of the range sits the volatility trigger level aka “zero gamma”. Options dealers will be buyers up to that level, but transition to […]

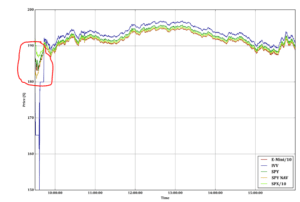

Notes From 8/24/2015 Crash

Monday August 24th 2015 was a memorable day and it seemed like a good idea for a quick review given how much the current market seems to be trading. This is not a prediction for a market crash. There were a litany of reasons credited with causing the crash ( go here to see). Markets […]

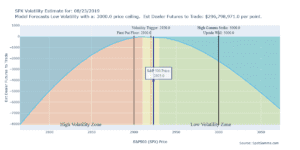

FED, TRUMP, Gamma Trap: Crazy Trading Day 8/23/19

Fed gave a speech that was “volatility dampening” at 10AM. Trump didn’t like what the Fed had to say so he started tweet-trashing the Fed and China triggering a “gamma trap“. Stock markets were just at the volatility trigger level of 2920 (black horizontal line) so the gap down flipped the trigger and dealers were […]

Gamma Market From 8/16/19

Volatility will continue to reign until (if) the market recaptures 2920. There is a ton of fuel ready to burn and one headline (or tweet) will send the market flying. The only recommendation that is safe here is to not sell any options, being short volatility is very dangerous here, as a >3% rally is […]

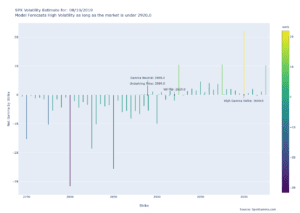

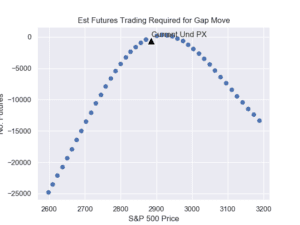

Dealers Running Out of Gas 8/16/19

After a sharp rally this morning the S&P500 stands at ~2890. This is where dealers buying starts to soften up. You can see their volume profile in the chart below. They were strong buyers up to this level but we calculated 2891 as the level where their buying wanes and 2920 where they flip to […]

VFlip Strikes Again 8/13/19

Like Haden warned us, based on ASDFG levels, on 7/31 markets broke under the VFLIP Volatility Indicator, triggering a market environment market by high volatility. As you can see that proved true with >10 days in a row with a >1% move. With a major options expiration at the end of the week there should […]