A strange thing has been happening in the options market recently, and I believe that is driving a lot of the intraday volatility we have been seeing. Yesterday (5/27) for instance, the S&P500 Index moved just under 100 total handles on the day. Take a look at the end of day snapshot of put volume […]

Market Analysis

The Volatility Trigger for ES Futures Traders

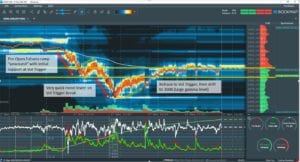

Wednesday 5/27 was a great example of how the Volatility Trigger can be a key level in trading. The concept of the volatility trigger is that when the market moves below the Trigger, options dealers are short gamma. This may mean that they start to sell futures as the market moves lower, and but futures […]

Overnight Outperforms?

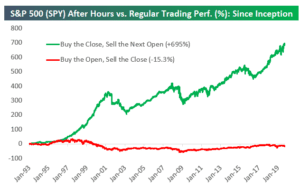

There is well knows research which shows that the overnight session in ES/SPX is the source of most of the positive market performance. This chart from Bespoke does a great job highlighting this. We have thought a lot about this, and had a theory that this out-performance may be due in part to options hedging […]

ZoneTraderPro Futures Trade Review

Our friends at ZoneTraderPro have a great trade review from Friday 5/22, where the incorporate SpotGamma levels into their unique ES futures trading signals and plan.

SpotGamma Presentation Futures Liquidity

Join SpotGamma & Trade To Win to talk about options levels and futures liquidity.

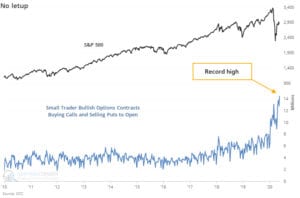

Attack of Risk Reversal

@SentimentTrader posted this chart showing record “small” positions in long calls and short puts. Sentiment says these are “10 contracts or fewer per trade”, insinuating retail traders. This type of trade (long call/short put) is a position also known as a risk reversal. While the traders are not likely actually trading short puts and long […]

Mondays Market SPX Slide 5/12/20

Yesterday markets fell apart pretty quickly and that leads us to highlight ES volume and the poor liquidity seen. You can see in the chart below that ES volume was higher than its recently been and a lot of that was concentrated into the close. This leads us to an interesting point about ES Futures […]

Nomura Pre May OPEX Update

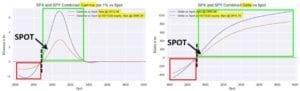

Like we have been highlighting to subscribers this weeks May SPX options expiration (OPEX) (Friday AM) could bring a state change to markets. From ZH we find another note from Nomura, echoing our sentiment: Into this week’s options expiry, Spooz (ref 2927) continue to remain pretty-sticky between 3 of the 4 largest $Gamma strikes on […]

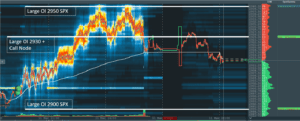

SPX Options Levels & ES Futures Trading

We believe that strikes with high open interest in the SPX create support and resistance lines for ES Futures trading. Here is one prime example. At top is the morning note we sent to subscribers at at the bottom you see those levels noted in the Bookmap futures trading platform. Futures currently trade at a […]

Morgan Stanley VIX & SPX Market Gamma Update

From Zerohedge we see some nice Gamma related research from Morgan Stanley. Posted below is their note. By Chris Metli of Morgan Stanley Quantitative Derivative Solutions The March 2020 equity selloff ushered a huge volatility shock that caused unprecedented losses for short volatility strategies. The impact is likely bigger than just a one-time hit to […]