Options flows blocking a market breakout Monday January 01 1999 Try SpotGamma HIRO Indicator for Free Real-time options data See when options drive stocks 0DTE filter for short-term trades Get Started Free Subscribe to the industry’s #1 platform delivering daily expert analysis to unveil: Proprietary market levels Bullish or bearish stocks Hidden trading risks Get […]

Michael Kramer

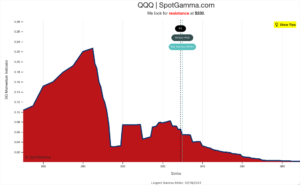

Gamma Levels Can Reveal Huge Forces Driving The Nasdaq

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The equity markets have had sharp drawdowns and extremely high volatility in 2022. While this dynamic has created a difficult backdrop for traders, the options market is playing a big role during these tricky times and SpotGamma indicators may provide an […]

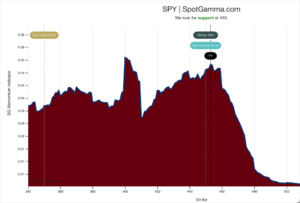

The Oversold Stock Market Could See a Bounce

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. The S&P 500 has fallen by more than 10% in the past two weeks, and to say that it is due for a bounce may be an understatement. The combination of a 75 bps Fed rate hike and massive June quarterly options expiration resulted […]

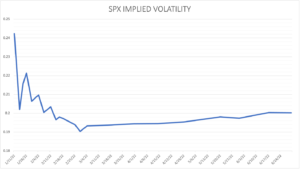

Will The Fed Push Stocks Over The Edge Next Week?

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Hard Landing Worries Are Driving Volatility Volatility in the market has been high as traders and investors look to hedge risks associated with the Fed and the potential for an economic slowdown. The concerns seemed to evolve, starting with inflation and growth worries. Now […]

The Fed Meeting May Spark The Next Stock Market Rally

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Buy the Fed meeting. Sell the Fed minutes. It may be the name of the game for the stock market. At least since the start of 2022, the minutes have been a cause of concern for markets, while the FOMC meetings […]

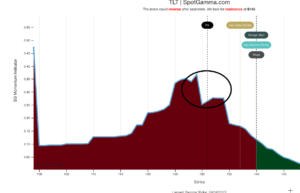

The TLT’s Recent Plunge May Be Over

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Bond yields have soared in 2022, sending ETFs like the iShares 20+ Year Treasury Bond ETF (TLT) lower by around 10%, but almost 25% off its 2020 highs. The ETF now comes to a critical juncture, signaling rates pushing significantly higher […]

The Sell-off For The NASDAQ May Not Be Over Yet

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. With the Fed pivoting to a very hawkish stance starting in 2022, the Nasdaq has witnessed a dramatic decline of nearly 18% since peaking in November. The drop may only continue in the weeks ahead as market participants try to figure out the potential […]

Next Week’s Fed Meeting May Create Massive Moves In The Market

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Stock market volatility has picked up, and it may only be starting. Investors are eagerly awaiting the next FOMC meeting on January 26 to try and gauge which way the Fed may choose to go in its fight with inflation. With […]

The S&P 500 May Drop An Additional 10%

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. On November 12, I warned that dreams of a seasonal run higher were in doubt and that an end-of-year melt-up could quickly turn into a meltdown. It seems that instead of stocks cruising into the end of the year, they have […]

If These Bond ETF Levels Break, You Better Buckle Up

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. There is instability in the bond market right now. In the face of a potential break, there may be a wave of volatility as market participants begin to price in changes to Fed monetary policy. Cracks are already showing as bond […]